Track income & expenses

Find on average $19,873 in deductions per year with QuickBooks Self-Employed.1

Connect your accounts

Automatically import transactions from your bank, credit cards, PayPal, Square, and more.2

Easily sort transactions

Expenses are auto-sorted into tax categories. You accept or edit them, we learn from you over time.

Create custom rules

You’re in the driver’s seat. Create rules for how you want us to categorize expenses.

Be ready for tax time

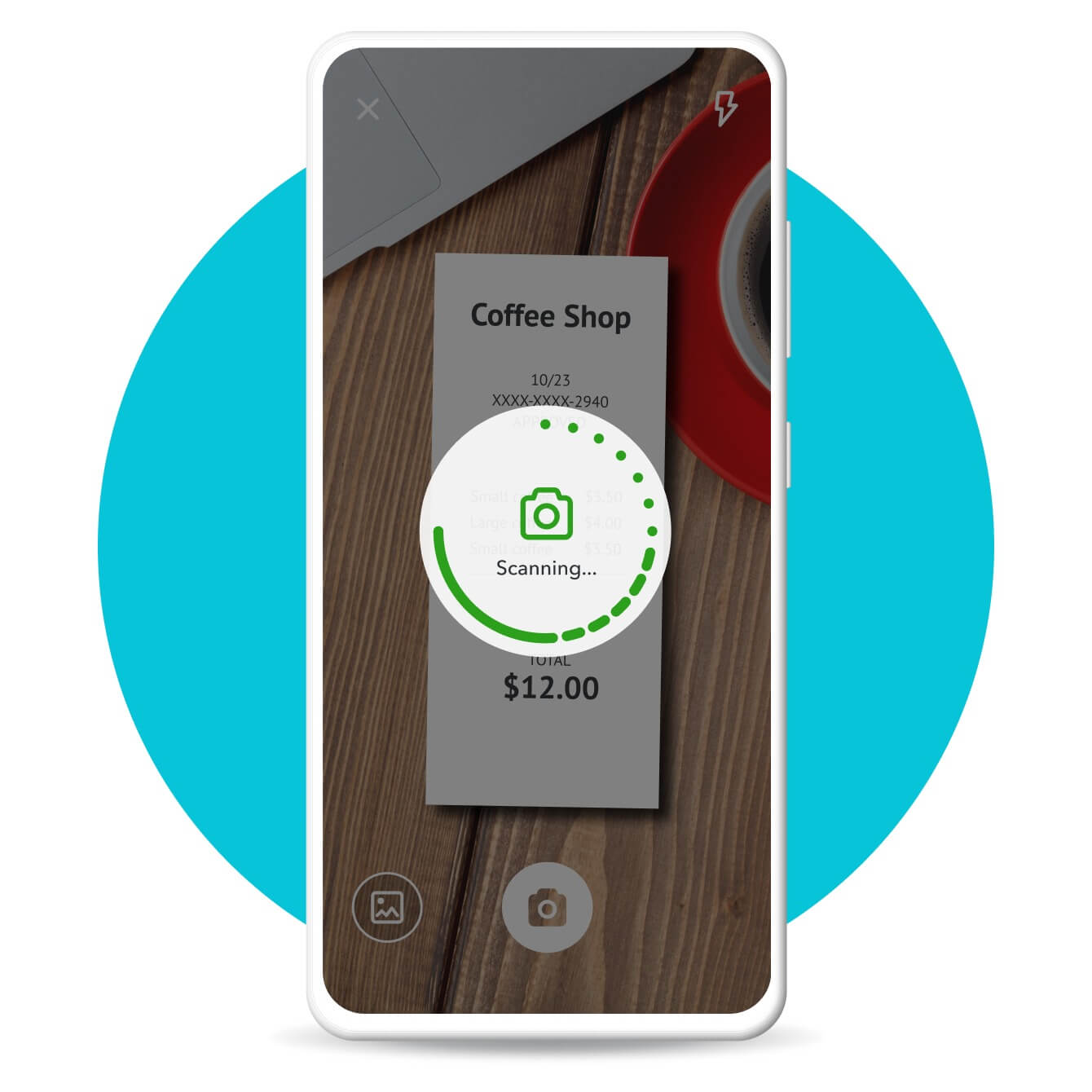

Effortlessly organize receipts

Snap and save photos of receipts, and we automatically match them to your expenses.

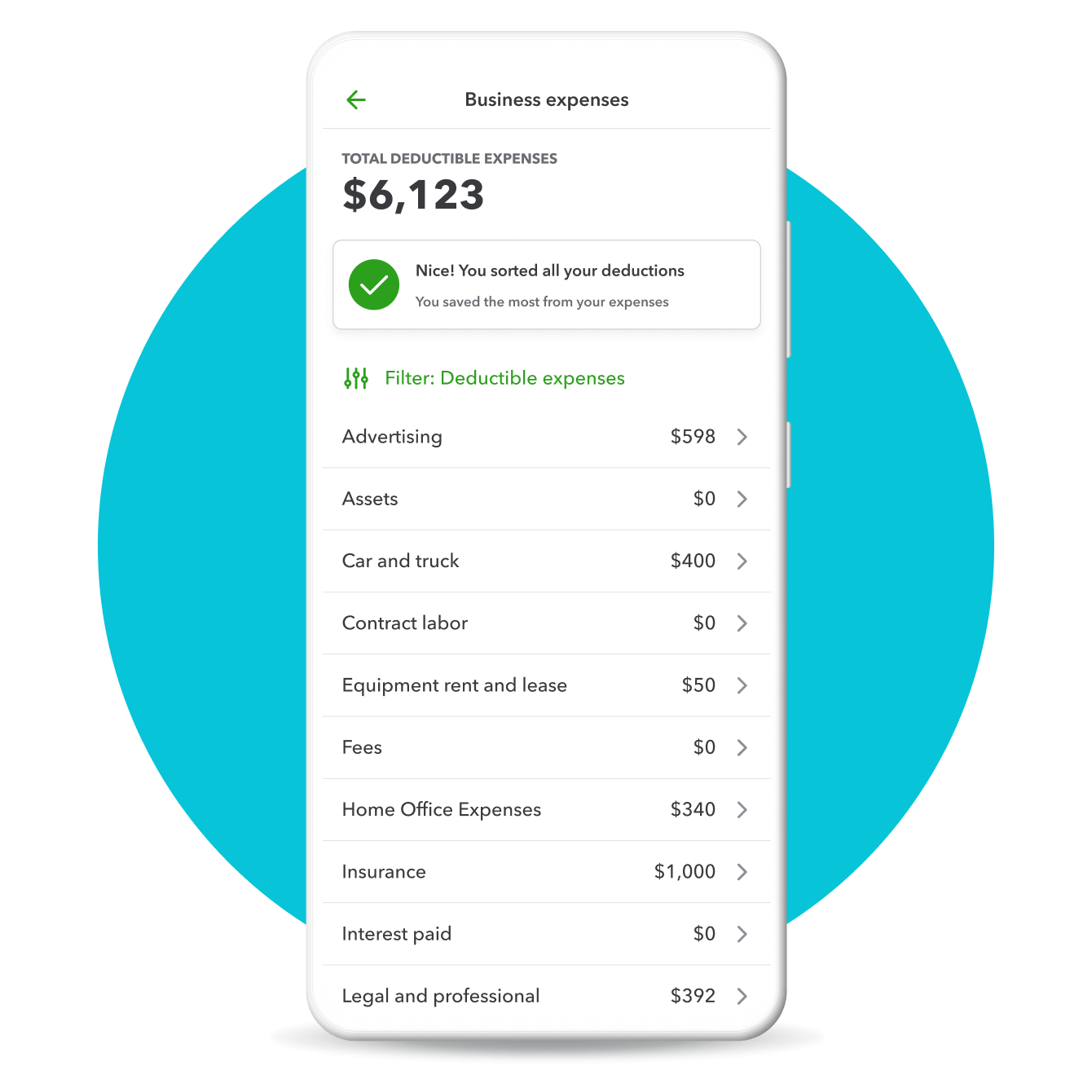

Uncover every tax deduction

Keep things organized in one place so you never miss a deduction.

Access and share built-in expense reports

Keep tabs on your finances

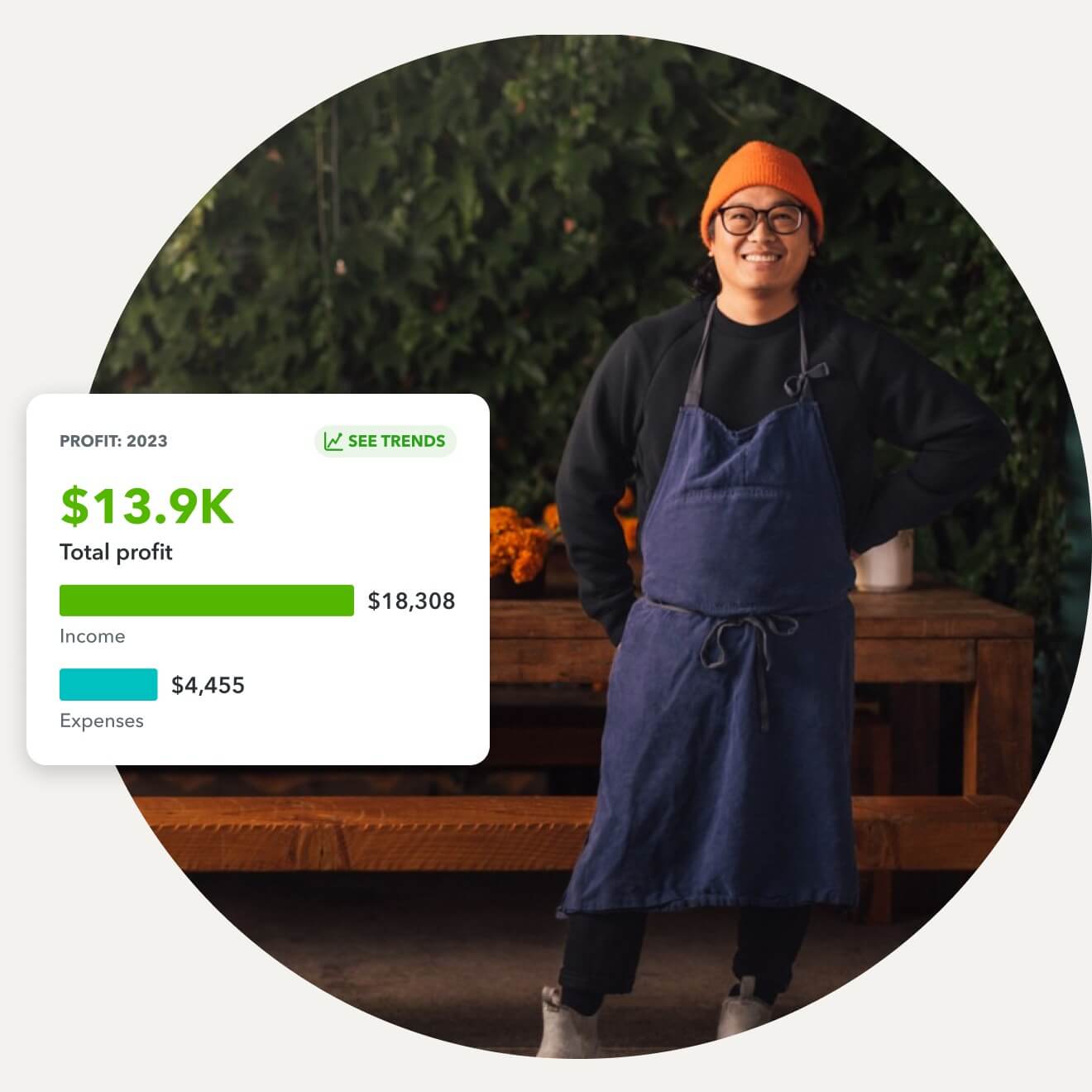

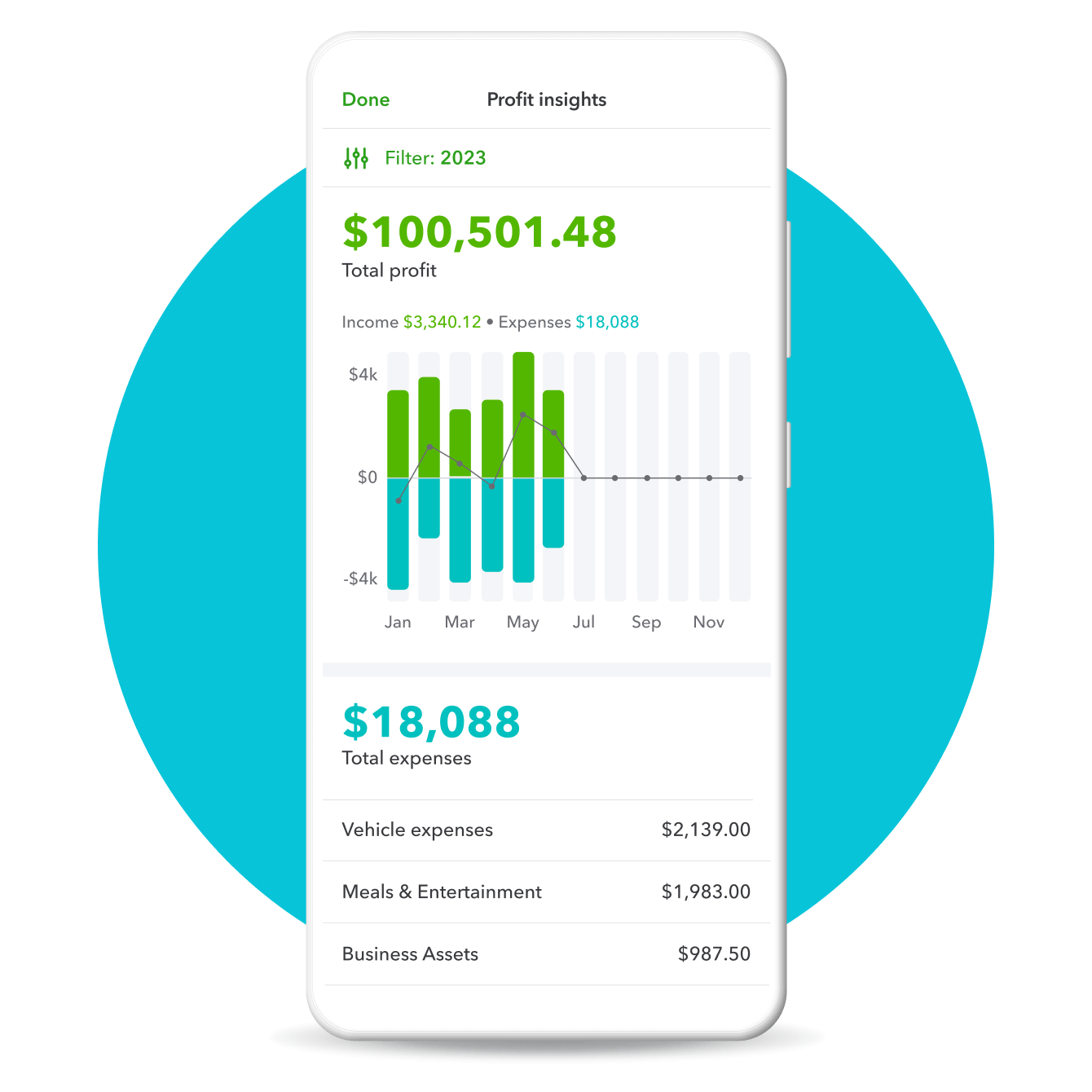

Make smarter decisions with instant access to key financials including income, expenses, outstanding invoices, and more.

Get valuable insights

Instantly see how you’re doing with profit & loss reports. Share them with your accountant for a better picture of your self-employed work.

Why track self-employed business expenses?

By tracking how each dollar is spent, you can see how you’re doing year-round and make sure you don’t leave money on the table at tax time.

Take business with you on any device

Easily track expenses from your mobile device with the QuickBooks Self-Employed app. Connect your bank account, credit cards, Square, or others to automatically import, categorize, and track expenses. Easily review your spending habits, keep an eye on expenses by client or job, track ongoing deductions, and more across all your devices.

Make it easy to get reimbursed

Do you have expenses for clients that can be reimbursed down the road, such as supply costs or rental equipment? No problem. QuickBooks Self-Employed makes it simple to track reimbursable expenses and add receipts to invoices.

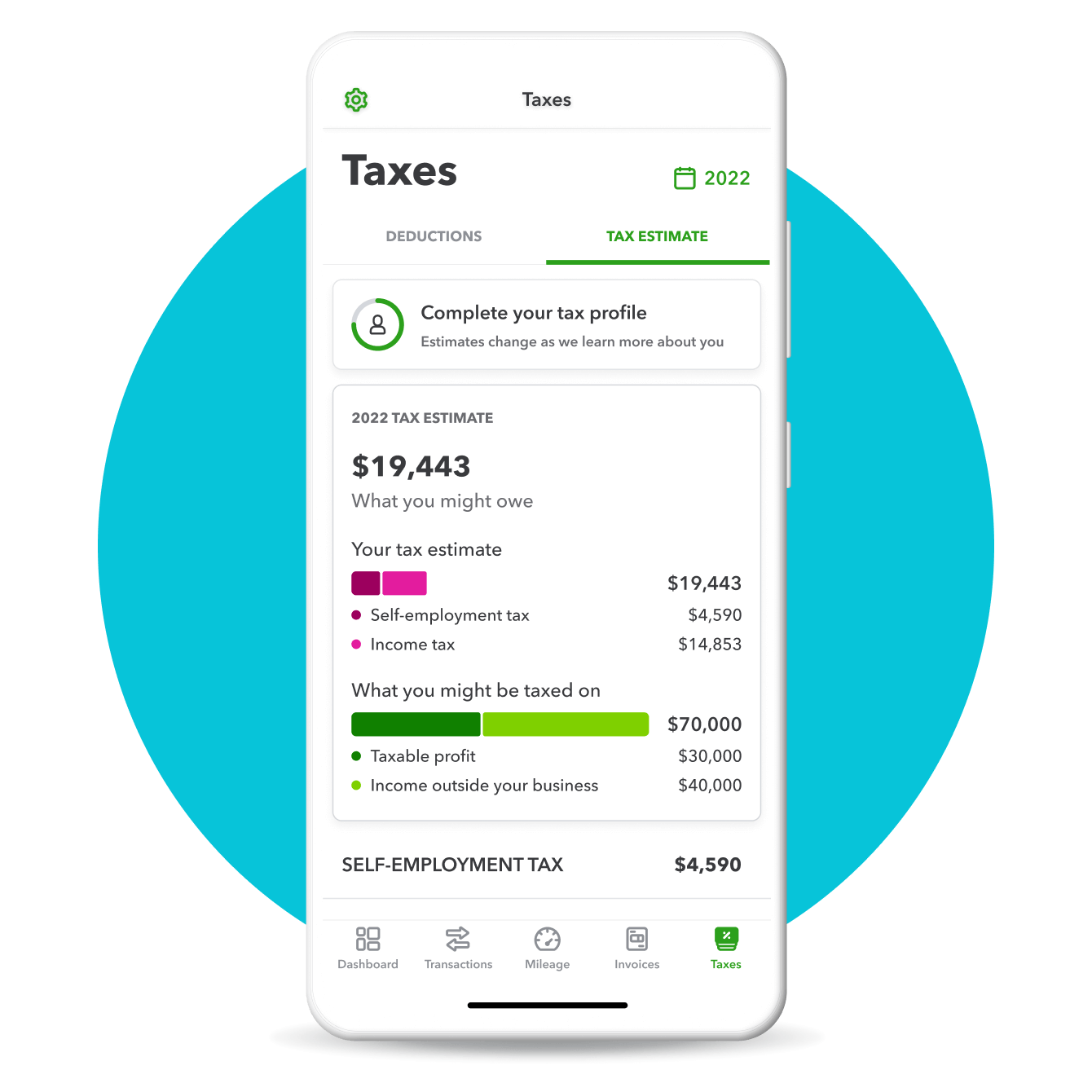

Put tax worries behind you

Expenses are auto-sorted into tax categories year-round so that you can easily file them for deductions at tax time. Plus, stay on top of quarterly taxes with due date reminders and automatic estimates of what you owe.

Receipt tracking for self-employed expenses

The importance of keeping receipts stored and accessible cannot be overstated. At the end of the year, having an organized record of receipts already matched to your transactions makes tax time easier.

The IRS requires you to keep receipts used for any claim for up to six years. Anyone who has receipts that are even a few months old will tell you that the ink fades pretty fast. Plus, what happens if your wallet takes a swim or there’s an accident or natural disaster that makes your physical files unreadable?

With a receipt tracking app like QuickBooks Self-Employed, it’s very easy to address these issues. You can use your phone to snap a photo of your paper receipts and QuickBooks Self-Employed will automatically match them to your expenses and then store them for you. Plus, your data is backed up in the cloud, keeping receipts safe and accessible anytime.

Built-in receipt scanner and tracker

The QuickBooks Self-Employed app comes with built-in receipt scanning to help you track and organize your expenses. Simply snap a photo of a receipt and QuickBooks Self-Employed will attach it to the expense it matches. When it comes time to file taxes, receipts are stored and ready to use.

Search for scanned receipts

QuickBooks Self-Employed keeps your receipts organized in one place and makes them easily searchable. After you scan receipts, you can use the search bar to find a particular receipt anytime. Does your accountant need a specific receipt to help you with your taxes or expense reports? No problem.

Survey reveals how self-employed workers approach expense tracking

From tracking expenses to budgeting and preparing taxes, entrepreneurship can be just as challenging as it is thrilling. QuickBooks Self-Employed asked 1,026 self-employed people in the United States about how they track their business expenses, sort through stacks of receipts, and handle the strain of tax season.

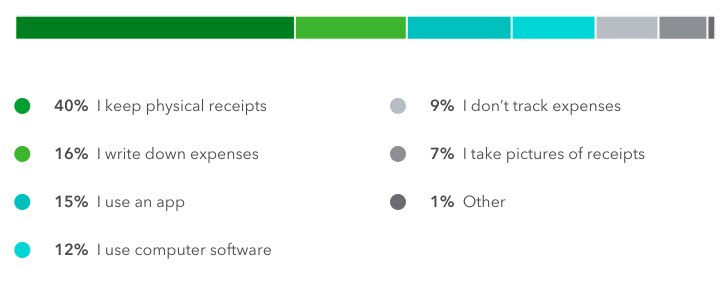

Collecting paper receipts

Antiquated though it may seem, most self-employed workers keep track of their expenses solely with paper receipts.

Common concerns with expense tracking

Surprisingly, only 14% of self-employed workers track expenses with an app, and over half (55%) of workers don’t keep digital copies of receipts. Let’s dive into why some people say they don’t track expenses and the reality of why they should.

Concern: I don’t have enough expenses.

Reality: Even if you don’t have many expenses, having oversight of money coming in and out helps you quickly understand how your business is doing.

Concern: My business isn’t big enough.

Reality: Every business expense counts, especially for freelancers. Saving your receipt for that new laptop ensures that you won’t forget it at tax time.

Concern: It’s too much work.

Reality: Tracking expenses digitally is one of the easiest ways to stay on top of things as you go.

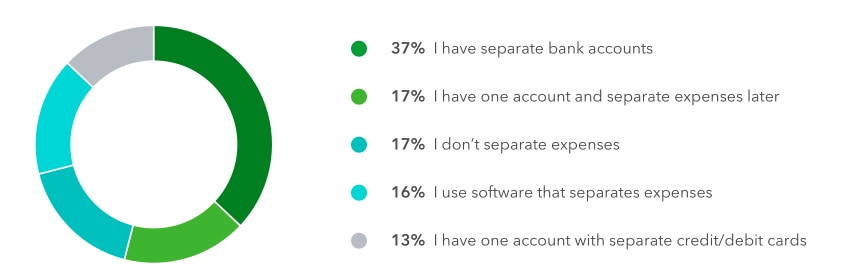

Separating business from personal expenses

It’s tough to be your own expense manager. Only 36% of self-employed workers have separate bank accounts for their business and personal expenses. This can lead to crossover when it comes to spending from either account.

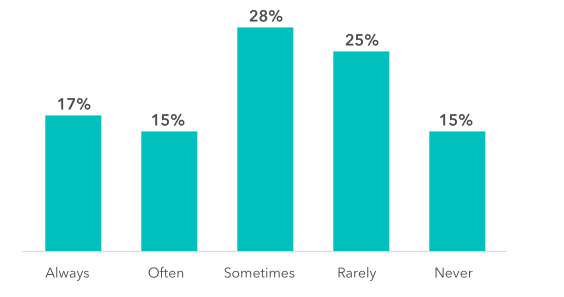

About 14% of self-employed workers say they never charge business expenses to their personal accounts, while nearly a third (31%) say they always or often do. On the other hand, 33% of self-employed workers say they never make personal purchases from a business account, and 22% say they always or often do.

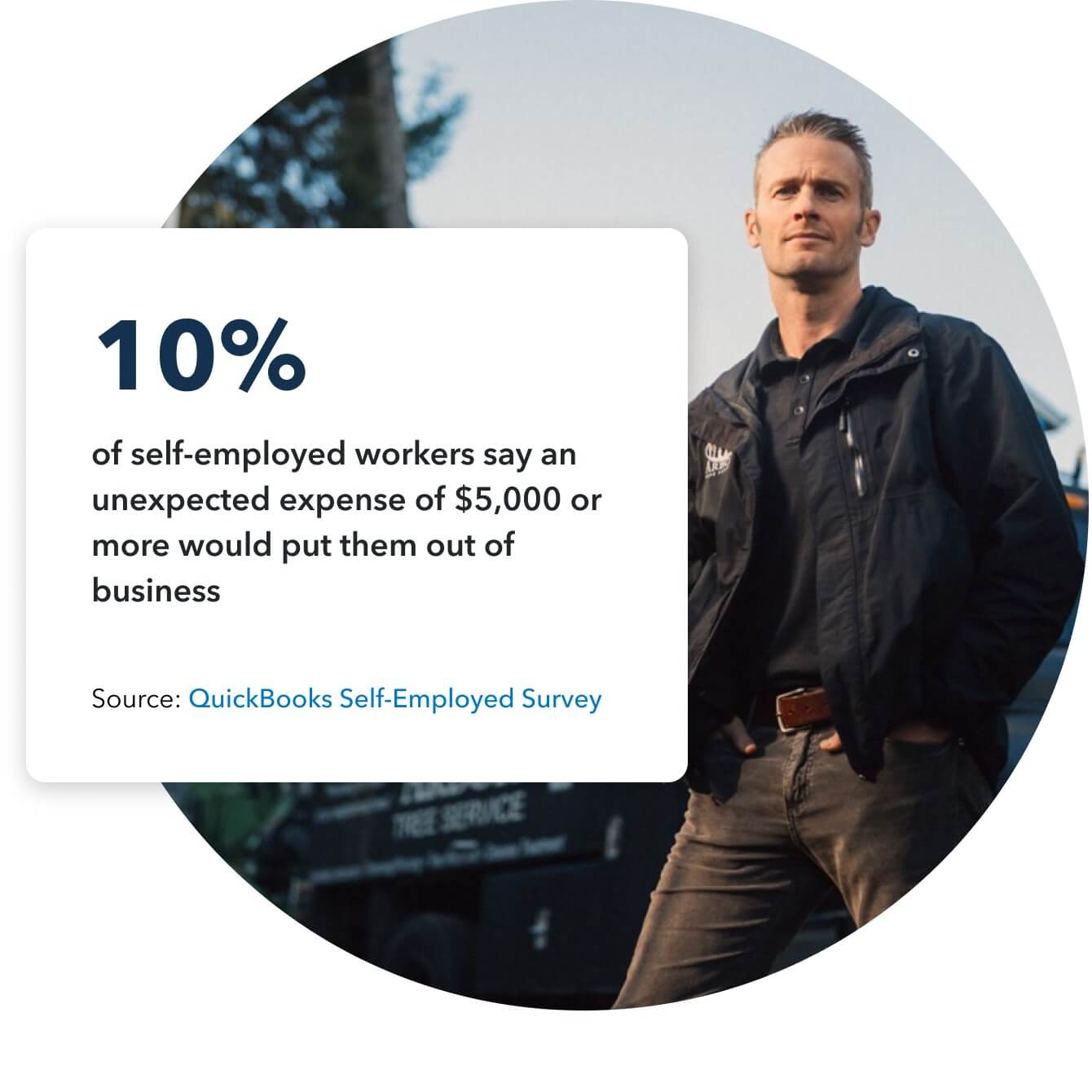

Budgeting for the unexpected

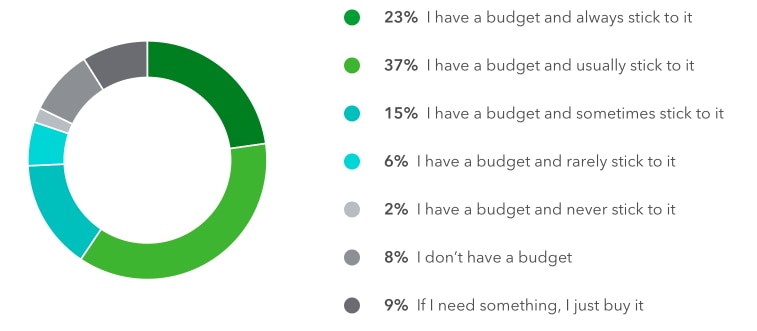

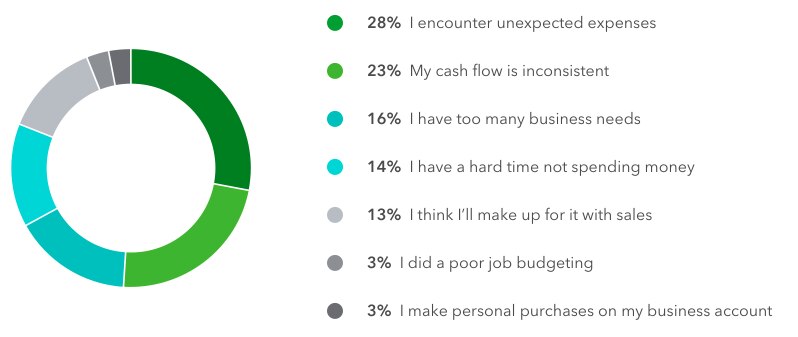

Owning a successful business means having a safety net, either with savings or a budget that accounts for the unexpected. But having a budget and sticking to it are two different matters. While 82% of self-employed workers create a budget for their business, only 22% always adhere to it. Unexpected expenses are the number one reason that self-employed workers overspend their budgets.

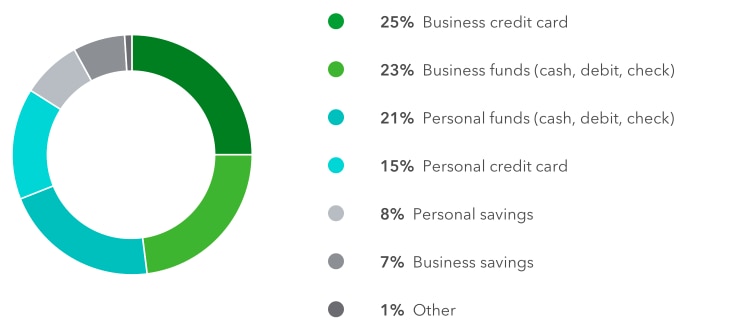

When asked how they’d pay for an unexpected expense of over $5,000, over 60% said they’d have to go into debt to pay it. Over a third (35%) of self-employed workers said they’d need to put the expense on a business or personal credit card.

While credit cards are a solution for some, 10% of self-employed workers said a business loan would be their fallback. And 10% said an unexpected expense of that size would put them out of business.

Anticipating tax season

Navigating tax season is undoubtedly one of the most stressful parts of being self-employed. Even when you do all your tax prep by the book, use an expense tracking app, or manage expenses in a spreadsheet, tax season can still be stressful. In fact, most self-employed workers prefer to endure typically scary hypotheticals like clowns or flying.

Things self-employed workers prefer to tax season:

...Flying

...Clowns

...Public speaking

...Needles

Missing out on deductions

Too often, self-employed workers miss out on getting the most deductions at tax time. Despite the fact that 25% of self-employed workers spend $100,000 or more on business expenses, only about 19% deduct $100,000 or more from their taxes.

Of the 26% of self-employed workers who spend between $1,000 and $10,000 on business expenses each year, 54% deduct that amount from their expenses.

Top 3 ways self-employed workers determine when to deduct a business expense:

1. They ask their accountant.

2. They Google it.

3. They trust their gut instinct.

Guessing at deductions

Only 7% of self-employed workers say they guess when it comes to deductions, and 6% say they “just deduct it.” Meanwhile, 73% of self-employed workers deduct expenses they think they shouldn’t have, and 1 in 5 says they always or often do.

All the tax feels

Though not all entrepreneurs can attest to finding the right deductions, 81% say they’d feel confident in their expenses and deductions if the IRS audited them. A significant number (about 16%), however, say they’d be nervous.

Age and expense tracking habits

According to the survey, younger self-employed workers (ages 18-44) today spend less money on their businesses. The highest percentage of 18- to 44-year-old respondents spends between $1,000 and $5,000 on their businesses each year. Meanwhile, the highest percentage of older respondents (45- to 54-year-olds and older) spends between $5,000 and $10,000 a year on their businesses.

When it comes to expense tracking, though, older self-employed workers (45- to 54-year-olds and older) tend to track expenses for different reasons than those who are younger. The highest percentage of the age group (41.45%) of the age group tracks expenses to make taxes easier. The highest percentage of the 18-44 age groups tracks expenses, so they know how much they’re spending.

*QuickBooks Self-Employed surveyed 1,026 self-employed people throughout the U.S. in December 2018. The sample was selected by Pollfish. QuickBooks Self-Employed welcomes the re-use of this data under the terms of the Creative Commons Attribution License 4.0, which permits unrestricted use, distribution, and reproduction in any medium provided the original source is cited with attribution to https://quickbooks.intuit.com/self-employed/.