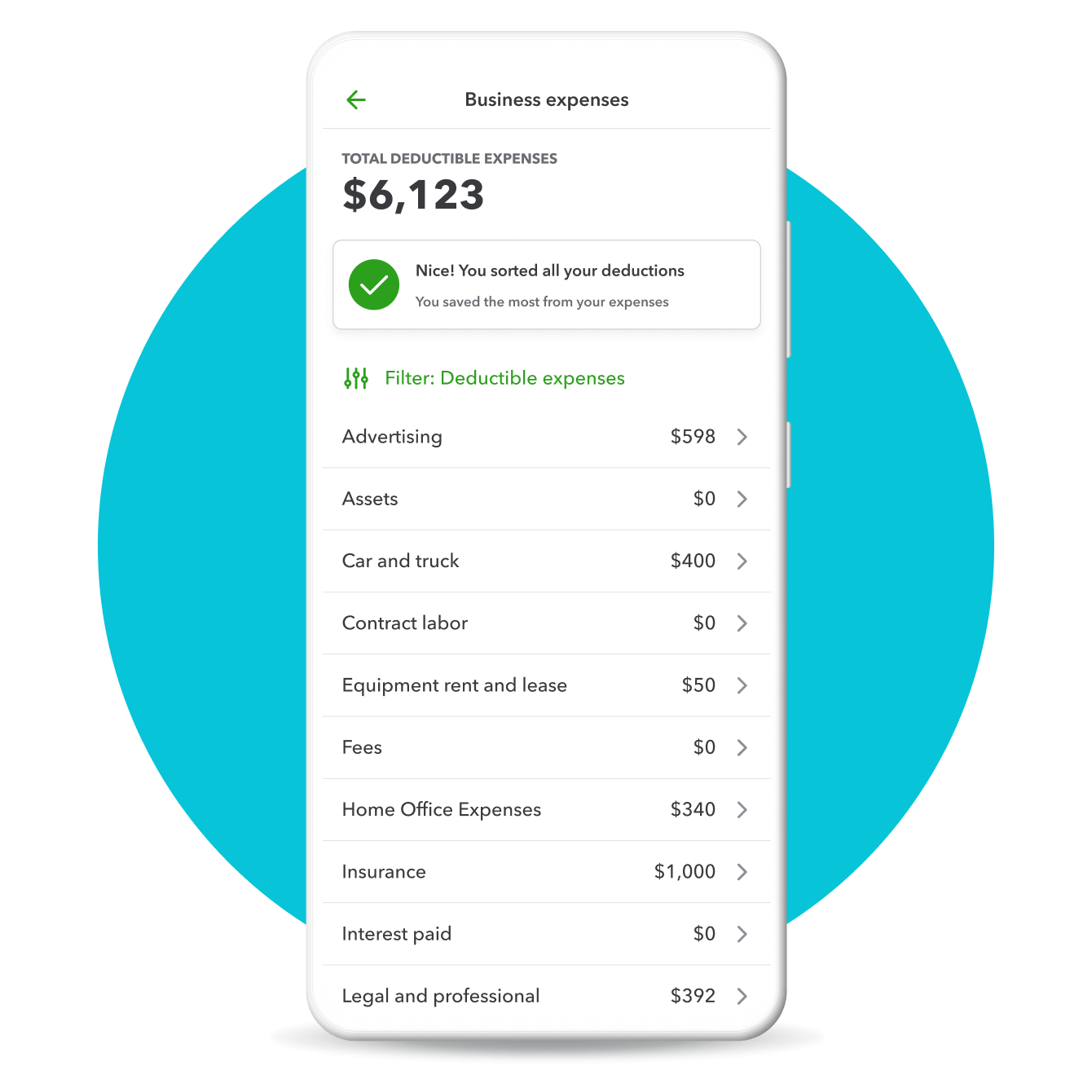

Maximize tax deductions

Users have found hundreds of millions in potential tax savings using QuickBooks Self-Employed.1

Auto-track as you go

Connect your bank credit cards so that business expenses are automatically synced as you spend.

Smart organization

We make it easy to sort expenses into the right tax categories, or have them auto-sorted in the background.

Store receipts with snap

Snap photos of your receipts and we’ll automatically match them to your business expenses.

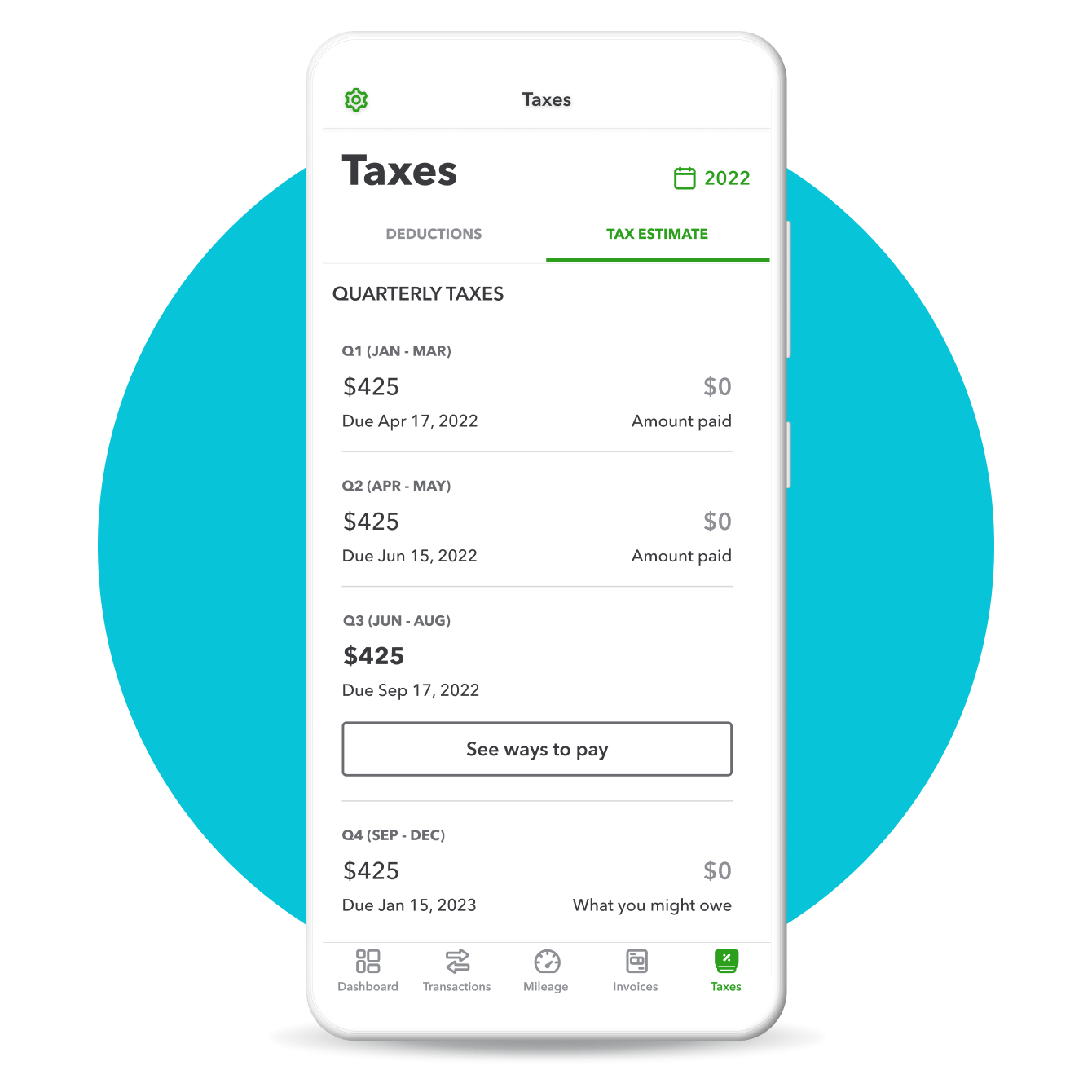

Easy quarterly taxes

We do the math so you can avoid year-end surprises.

- Know what you owe each quarter before taxes are due

- Avoid late fees with automatic reminders of quarterly tax due dates

- Easily organize income & expenses for instant filing

Taxes are done

Upgrade to the TurboTax bundle and instantly transfer your financial data.

- Connect to TurboTax Self-Employed to reduce manual entry

- Easily transfer Schedule C income and expenses

- One federal and one state tax return filing included

Tax forms

At the start of each year, companies are required to send out tax forms to everyone the paid throughout the previous year. This includes independent contractors or freelancers. As a self-employed person, you then need to complete and submit various tax forms. Here’s a look at those tax forms.

1099-MISC

Like most self-employed workers, you probably receive 1099s for your work with any business that pays you over $600. If you earn less than $600 from a particular client, you still need to report the income on your tax return, but you won’t receive a 1099 form.

Tax Form 1040

Use Form 1040 to report your total annual income and deductions for the year, which will help you figure out how much income tax you owe. Payment for Form 1040 is due on April 15.

Some of your expenses as an independent contractor will go on the 1040 instead of on your Schedule C. For example, if you pay for your own health insurance and aren’t eligible for a spousal or employer-sponsored plan, you can claim that as an above-the-line deduction on your 1040.

Schedule C

A Schedule C is a tax form filed with your personal tax return that helps you calculate the profit or loss from your business. Use it to tell the government how much you made (earnings), how much you spent (expenses), and if that resulted in a profit or loss.

A Schedule C-EZ is just a simplified (“easy”) version. You can use the C-EZ only if you meet certain requirements. The major requirements are that you only run one type of business and don’t have more than $5,000 in business expenses.

You must include a Schedule C or C-EZ with your Form 1040 during year-end taxes. You might also complete one when filing quarterly taxes with a 1040-ES.

Schedule SE (Form 1040)

Use Schedule SE on Form 1040 to calculate the self-employment tax you owe. Without an employer withholding Social Security and Medicare taxes from your paycheck, you need to calculate and pay those taxes yourself. This is called the self-employment tax, and Schedule SE on Form 1040 helps you calculate it.

Form 1040-ES

Generally, most independent contractors have to submit taxes to the government every quarter. There are some specific regulations for this, but generally you have to pay quarterly taxes if you expect to owe $1,000 or more in taxes for the year (roughly, if you plan to make more than $5,000 in 1099 income).

Before you file quarterly taxes, use Form 1040-ES to estimate how much you’ll make during the year and how much tax you expect to pay on those earnings. The 1040-ES form includes a payment voucher that you send to the government with your estimated quarterly tax payment.

Estimated taxes

As a self-employed professional, you pay taxes to the government yourself, not through an employer. You do this by paying quarterly taxes in amounts that you’ve estimated you’ll owe based on your income.

How to file estimated taxes

Use a Form 1040-ES to estimate how much you’ll make during the year and how much tax you expect to pay on those earnings. Then, pay a portion of that each quarter by filling out the payment voucher on Form 1040-ES. You should complete a 1040-ES each quarter because your estimated income for the year might change over the course of three months, depending on how much you work.

There is also a “safe harbor rule“. If you expect to make more this year than you did last year, the government only requires you to pay at least 100% of what you paid last year (110% if you make more than $150,000). You’ll still have to pay the full amount of what you owe at the end of the year, but this basically gives you an interest-free loan until the end of the year.

Is there a penalty for miscalculating or not paying estimated taxes?

What if you didn’t pay quarterly taxes or actually owe far more than you estimated? You’ll typically pay a fine or penalty that can be as much as 10% for federal and 10% for your state. So if you owed $5,000 in federal taxes and $1,000 in state taxes and didn’t pay throughout the year, you could owe up to $600 in additional fines and penalties. Depending on how much you paid throughout the year, you might over or underpay. If you overpay on quarterly taxes, you get a refund at the end of the year. If you underpay on quarterly taxes, you pay the difference at the end of the year, plus penalties and interest.

You only owe taxes on your business profit, which is business earnings minus business expenses. Make sure you’re keeping good track of these, so you don’t lose money to taxes you can’t get back.

Estimated taxes due dates

Quarter 1

Covers Jan. 1 – March 31

Due April 15

Quarter 2

Covers April 1 – May 31

Due June 17

Quarter 3

Covers June 1 – Aug. 31

Due Sept. 16

Quarter 4

Covers Sept. 1 – Dec. 31

Due Jan. 15

QuickBooks Self-Employed calculates your quarterly tax estimates for you.

Because QuickBooks Self-Employed tracks and organizes all of your income and expenses throughout the year, it calculates your quarterly estimated taxes for you. Easily see your estimated payments for each quarter and their respective due dates. Plus, keep track of the tax payments you’ve already made to stay organized for filing your annual tax return.

To make an estimated tax payment, it’s easy to fill out the payment voucher for form 1040-ES directly inside QuickBooks Self-Employed. Then, print and pay by mail or pay online with the Tax Bundle.

Self-employment tax

Part of every American’s income goes towards supporting Social Security and Medicare. This is called the FICA tax if you’re an employee or SECA tax if you’re self-employed. When you’re an employee, your FICA tax is about 7.5% and your employer pays another 7.5% for you. When you’re self-employed, you pay the full 15% (actually 15.3%) yourself, which is why it’s nicknamed the “self-employment tax.”

How to file estimated taxes

The self-employment tax is calculated on a Schedule SE (SE stands for self-employment). After you figure out your net profit on a Schedule C (your earnings minus expenses), you then calculate how much of that is subject to the self-employment tax. All of these calculations are built into the forms you file as part of your federal tax return.

- The Social Security tax is 12.4% of your self-employment earnings up to $118,500. Any amount you make as a self-employed individual over that amount is exempt from this tax.

- The Medicare tax is 2.9% of your self-employment earnings. Medicare tax is applied to all of your earnings.

To ease the burden on self-employed individuals, the federal government allows you to calculate your net earnings, reducing your taxable income by 7.65%.

Here is an example of a self-employment tax calculation:

Find revenue

In this scenario, your self-employed business revenue earnings for 2018 is $50,000.

Calculate net earnings

Multiply your earnings by 0.9235, as you only need to pay taxes on 92.35% of your self-employed revenue. This results in $46,175 — your net earnings.

Determine taxes owed

Then, find 15.3% of $46,174/, which comes out to $7,064.62 for the Social Security and Medicare taxes you owe, your self-employment tax.

Fill out 1040 Form

List this entire self-employment tax amount on the 1040 Form under “Other Taxes.”

Report adjustment

Then, divide your self-employment tax in half, which comes out to $3,532.31. Report this amount as an adjustment to income on your 1040 Form.

By recording half of your self-employment tax as an adjustment to your gross income, you’ll be required to pay less income tax overall. Also, there is an Additional Medicare Tax of 0.9% that only applies if your income exceeds $200,000 if filing as a single person, or more than $250,000 if married and filing jointly.

Automate self-employment tax calculations

QuickBooks Self-Employed calculates your self-employment tax for you. Because it tracks your income and expenses throughout the year, it will automatically calculate the amount of self-employment tax you owe. The self-employment tax is part of the estimated tax payments you make quarterly using the payment voucher on Form 1040-ES. You can fill out the payment voucher directly inside QuickBooks Self-Employed, print it, and mail it with your payment. Or you can file online with the Tax Bundle.

Schedule C

Self-employed workers and sole proprietors use Schedule C to report profits or loss from their businesses. It details all deductible self-employed expenses. By subtracting expenses from your gross annual income, or total wages and revenue, you can calculate the net profit or net loss for a given tax period. You need to fill out Schedule C on Form 1040 (or C-EZ) before the April 15 deadline.

The first part of the Schedule C is where you report your earnings. You’ll notice some fields like “Returns” and “Cost of Goods Sold.” These are only applicable when you’re selling a physical product. Ignore them if you’re a service or on-demand worker.

The second part of Schedule C is where you’ll record any expenses related to your business. The IRS allows tax deductions for most business-related expenses.

Self-employed tax deductions

According to the IRS, those who are self-employed can deduct “ordinary and necessary” expenses. An ordinary expense is common and accepted in your trade or business. A necessary expense is helpful and appropriate for your job. To be considered deductible, the expense must meet both standards.

Tax deduction examples

Maximize Schedule C deductions

QuickBooks Self-Employed helps you easily separate your business and personal expenses so you can see your self-employed income and spending. All of your business expenses are automatically assigned to the appropriate Schedule C category. And with the Tax Bundle, you can export your Schedule C information directly into TurboTax Self-Employed. The bundle includes one federal and one state tax return filing. Plus, you can pay your quarterly taxes online.