As a small business owner, we know you’ve got a lot on your plate. Between managing supplies and satisfying customers, the last thing you need to worry about is an accounting error (or any error for that matter). With the right processes and tools in place, you can be equipped to handle any challenge that might come your way.

The 8-step accounting cycle: A 2023 beginner’s guide

What is the accounting cycle?

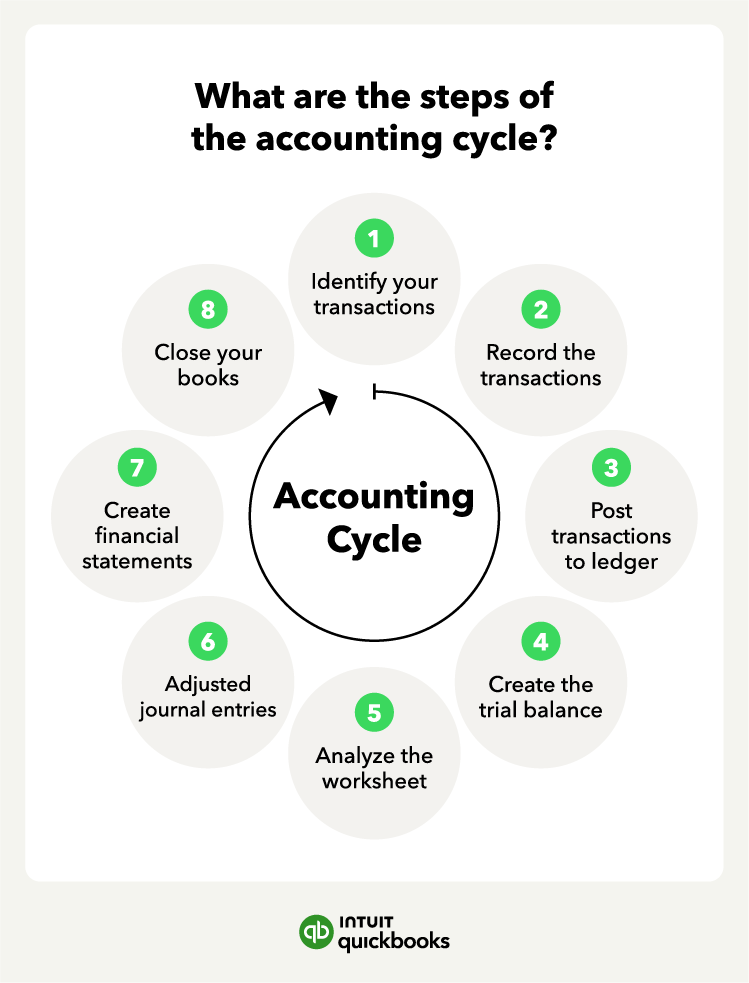

The accounting cycle is a series of 8 steps that a business uses to identify, analyze, and record transactions and the company's accounting procedures—it’s an accounting term that all business owners should know.

One essential part of running a small business is managing your internal accounting cycle and bookkeeping. Creating a clear picture of your company’s financial health can be daunting, but an understanding of the accounting cycle steps with easy-to-use accounting tools can help you be prepared and continue doing what you love. Let’s get started.

Step 1. Identify your transactions

The first step in the accounting cycle is to identify your business’s transactions, such as vendor payments, sales, and purchases. Usually, bookkeepers or accountants are responsible for recording these transactions during the accounting cycle.

Important information to identify includes:

- Transaction dates

- Product prices

- Amounts paid

For example, a marina that sells boats will need to keep track of each transaction they make through purchases of equipment, parts, or services rendered over the accounting period. They will also want to note important information to make categorizing and following steps easier.

Step 2. Record the transactions

The next step is to record these transactions in a journal or in accounting software, for a more efficient method. Storing information is a crucial part of the accounting process and can happen either at the point of sale (during the first step) or as a second step on its own.

A few things to remember when recording transactions:

- Maintain chronological order of transactions

- Ensure credits and debits balance each other out when using double-entry accounting

- Include important notes for the accountant for easier reconciliation

You can do this step manually, but businesses can use accounting software for simpler storage recall and organization of transactions.

Step 3. Post transactions to the general ledger

Once you record everything and approve it, the next step is to post the transactions to the general ledger. Think of the general ledger as a summary sheet where all transactions live within categories.

The general ledger is the master list of any transaction information in journals divided into accounts. It lets you track your business’s finances and understand how much cash you have available.

Step 4. Create the trial balance

For the fourth step in the accounting cycle, you’ll need to balance transactions at the end of the accounting period, which can vary (monthly, quarterly, or annually) depending on the company.

The trial balance provides the company with insight into the balances in the account and discovers any discrepancies. Since no accounting method is seamless, you might find discrepancies when balancing your books.

Step 5. Analyze the worksheet

The next step is worksheet analysis, which can be complex at first. You’ll use a worksheet to balance the debits and credits. When you have credits and debits from your transactions that don’t balance, you have to review the entries and adjust accordingly.

Step 6. Adjust journal entries

The final step before you create your financial statements is making adjustments to account for any corrections for accruals or deferrals.

An example of an adjustment might be a salary or bill you pay later in the accounting period. Since it was recorded as accounts payable when the cost originally occurred, it requires an adjustment to remove the charge.

Step 7. Create financial statements

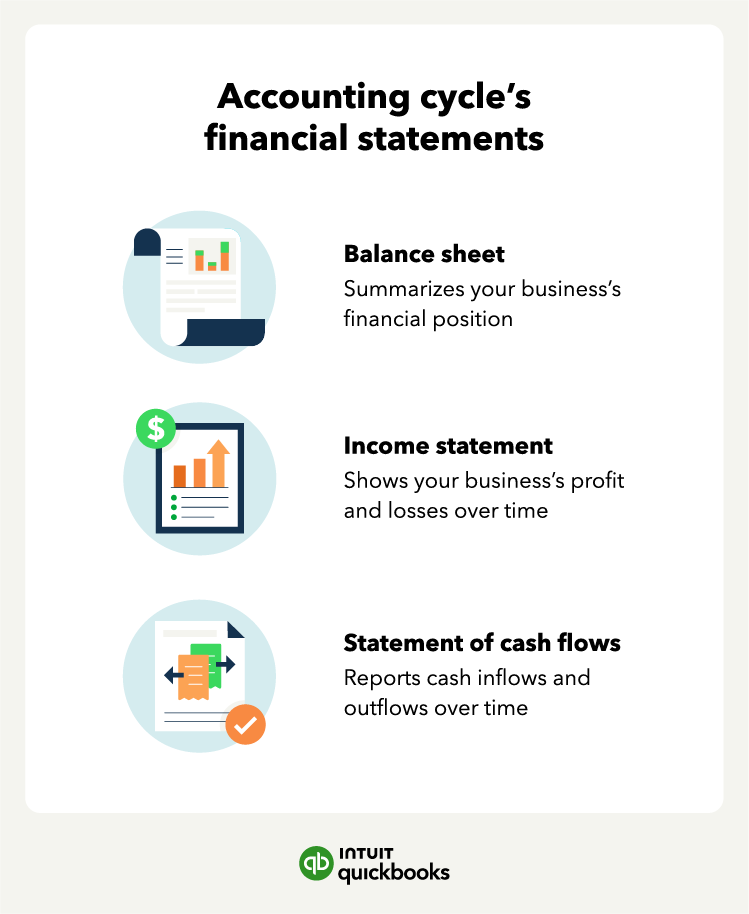

The next step is to generate financial statements, including the balance sheet, income statement, and cash flow statement, from the trial balance. Here’s a brief explanation of each financial statement:

- Balance sheet: Summarizes a company’s financial position of a specific date by subtracting assets from liabilities to determine equity. The most crucial part of the balance sheet is the profit and loss statement.

- Income statement: Reports a business’s profit or loss over time—typically, a month or year by subtracting expenses from revenues to determine net income or profit.

- Statement of cash flow: Reports cash inflows and outflows over time and separates them into operating, investing, and financing activities. The ending balance in the cash flow statement must equal the company’s cash balance on the balance sheet.

Many business owners focus on the balance sheet and income statements. But the cash flow statement is equally important to help you understand how your net income and the activity in the cash account compare.

Step 8. Close the books

Most accountants will confirm that closing the books is extremely satisfying. This happens at the end of each accounting period, signifying that the next accounting cycle can begin. Then, we begin the accounting process all over at step one.

Tips for successfully managing the accounting life cycle

Completing the accounting cycle every period can be time-consuming, especially if you have invoices and receipts scattered throughout your office. Here are some tips to improve your speed and accuracy.

Know your timing

Whether your accounting period is monthly, quarterly, or annually, timing is crucial to implementing the accounting cycle properly. Mapping out plans and dates that coincide with your accounting deadlines will increase productivity and results.

Troubleshoot errors quickly

Having eight steps in the overall accounting cycle may seem pretty straightforward, but it also means there are eight chances for your process to go awry. Locating and solving problems early will help carry out your process with more ease and efficiency. You can set up proper procedures for each step and create checks and balances to catch unwanted errors.

Modify the process to fit your needs

There is no one-size-fits-all solution for accounting practices. Each industry, company, and team operate differently. You may find early on that your system needs to be tweaked to accommodate your accounting habits.

For example, it can help to appoint one person to handle transactions because leaning on two or more could lead to discrepancies regarding which transactions are recorded to the proper accounts. Situations like these can easily lead to an incorrect trial balance and risk delayed closing of your company books.

Set your team up for success

Give your staff the tools they need to succeed in implementing the accounting cycle. This could mean providing quarterly training on best practices, meeting with your staff each cycle to find their pain points, or equipping them with the proper accounting tools. The better prepared your staff is, the more efficient they can be.

Try accounting software to lighten the load

Utilizing great tools to automate accounting processes, such as virtual bookkeeping, will not only make your job easier and faster. There are many tasks that you can automate and streamline through the use of a business accounting platform. Having your process go digital may seem daunting at first, but it will save you a lot of time in the long run.

Spend more time growing your business

As your business grows, so will your accounting needs. Creating an accounting process may require a significant time investment. Consider trying out accounting software to track expenses, work more efficiently, and minimize errors.

Setting up an effective process and understanding the accounting cycle can help you produce financial information that you can analyze quickly, helping your business run more smoothly.