Types of ledgers

There are several kinds of ledgers that you may use in the course of bookkeeping for your business. Most accounting software will compile some of these ledgers together while still letting you view them independently. Depending on the size of your business and what your business does, you may not need to use all of them. Here are some common types to be aware of and when to use them, beginning with a general ledger of course.

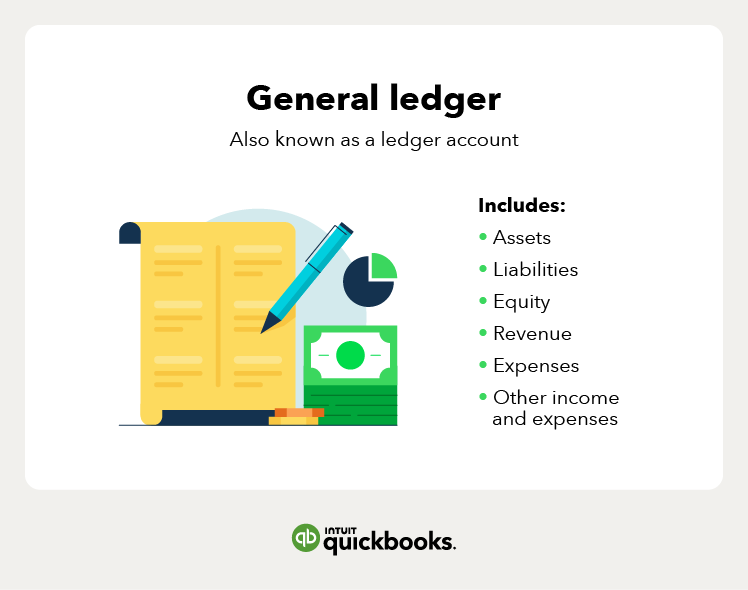

General ledger

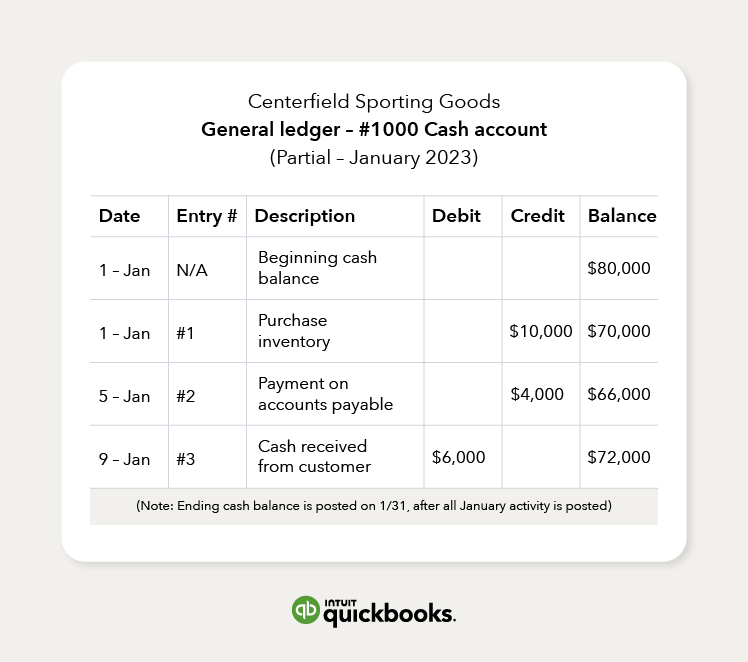

Also known as an accounting ledger, the general ledger serves as the record for a business’s financial data. This ledger is used to record each transaction and uses a trial balance to validate the information. With this ledger, a business can prepare its financial statements.

The information in a general letter is broken up into the following parts (also known as accounts):

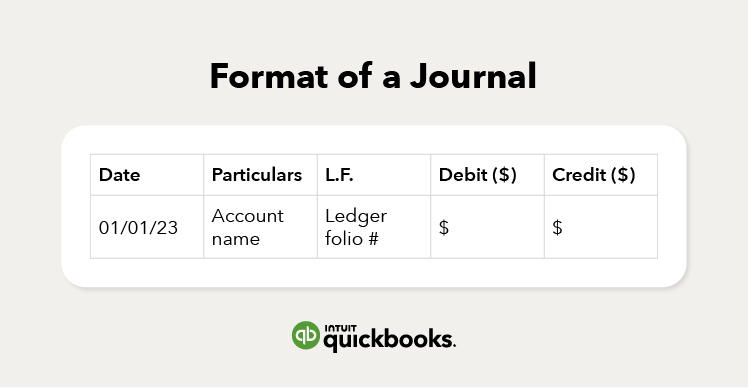

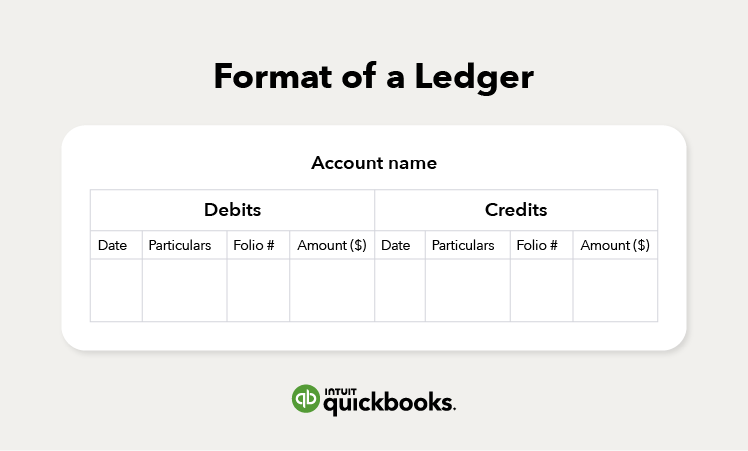

- A journal entry: This is where you record the journal entry number along with the entry date.

- A description: Here, you will describe the transaction in less detail than the actual journal entry.

- Debit and credit columns: For every entry, you’ll record a debit or credit.

- A balance: The general ledger will list the account balance whenever a debit or credit is posted to the account.

The general ledger also contains the chart of accounts, the main list of account numbers, and the names of each of the accounts, including:

Purchase ledger

Your purchase ledger is there to help you keep track of purchases. If your business doesn’t make enough purchases to warrant keeping them in its own ledger, you can include them in your general ledger.

Purchase ledgers can contain:

- Date of purchase

- Supplier names

- Invoice or purchase order numbers

- Amount paid

- Tax paid

Sales ledger

A sales ledger is a detailed list in chronological order of all sales made. This ledger can also be used to keep track of items that reduce the number of total sales, like returns and outstanding amounts still owed.

Sales ledgers can contain:

- Dates

- The name of the customer

- Invoice numbers

- The number of items sold

- Taxes charged on items sold

- Shipping costs

With modern accounting software, you may not have a purchase or sales ledger. Instead, they can be marked as a certain type of entry and called up in a search if you want to look at these entries on their own.