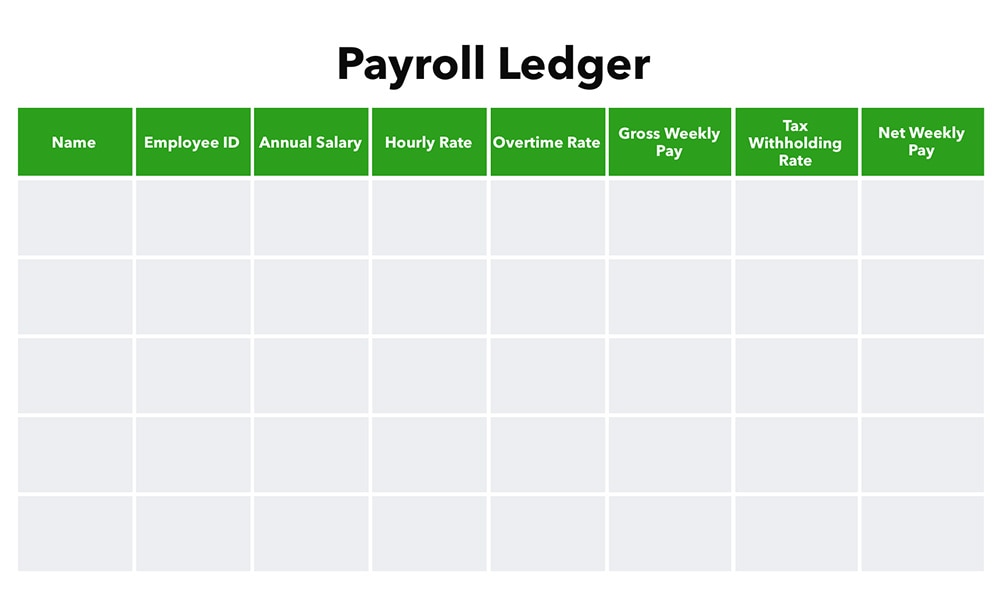

Using a manual payroll ledger template vs. payroll software

While payroll ledgers are a useful way to track and manage your employees’ pay, as a business owner, you have more options. Payroll software like QuickBooks Payroll incorporates functionality present in a payroll ledger while automating the input. By using software, you can keep tabs on employee pay, withholdings, gross pay, net pay, etc. much more efficiently.

Payroll software can also eliminate a major source of excess costs for small businesses—human error. Automating data entry means that you don’t have to worry about input errors, plus it means your employees can allocate that time to other tasks. And by automating the technical aspects of your employee payroll, you can ensure that your team is paid on time and in the correct amount. Plus, all the information you need to fulfill your IRS obligations will be in one place ready to import into your favored business tax software.

A payroll ledger may have some advantages for smaller businesses—they’re free, easily updated, and used to keep tabs on important information. But as your business expands, payroll ledgers can encounter some disadvantages. It may become more efficient to use dedicated payroll management software, like QuickBooks Payroll.

Before, you needed separate schedule templates, timesheet templates, budget templates, budgeting software, time cards, and payslip management strategies. But with QuickBooks Payroll, you can keep it all in one convenient place.

A few advantages of this software include:

- Tax penalty protection

- Time tracking

- Same-day direct deposit

- Auto payroll

- Automated payroll taxes and forms

- Expert support