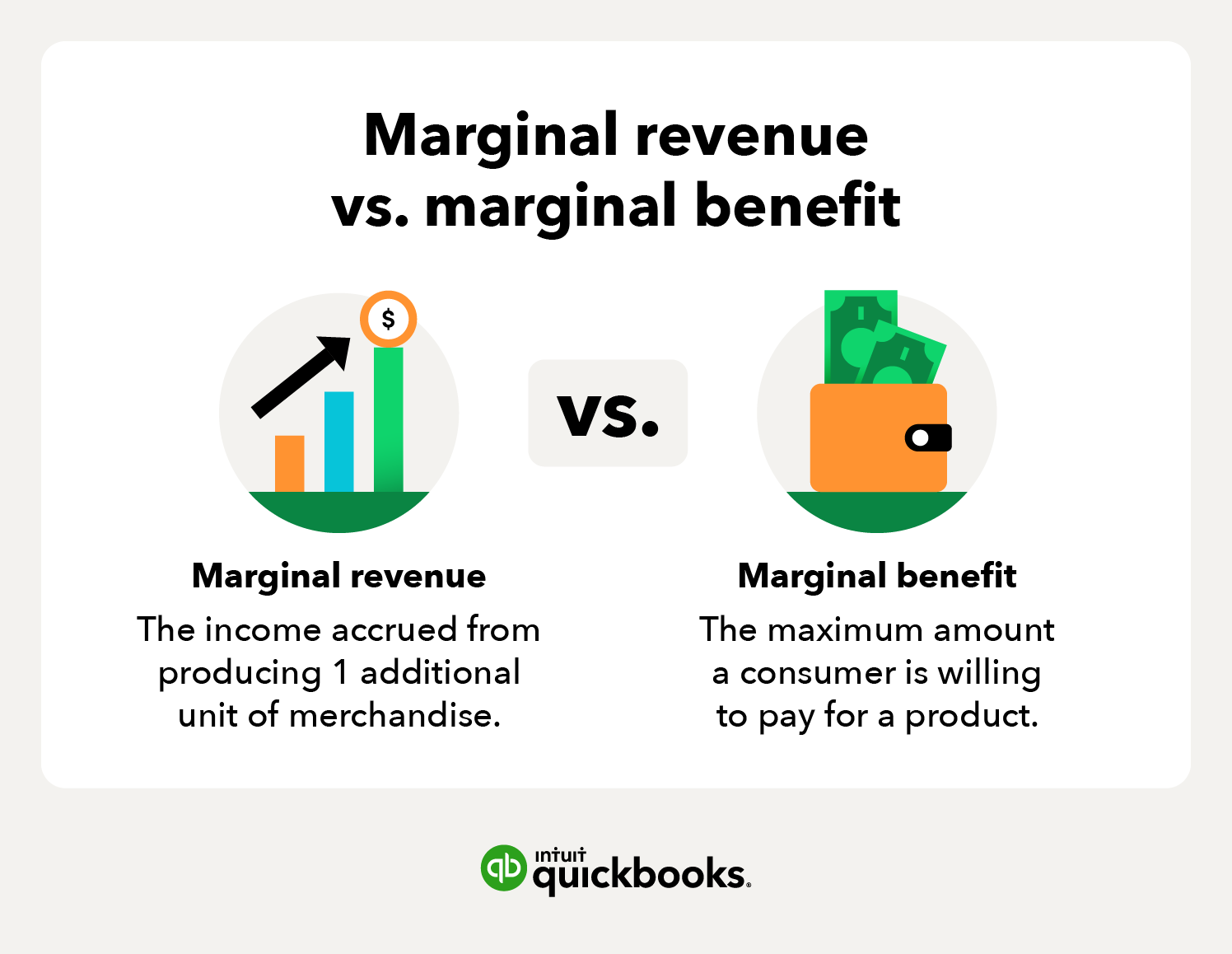

While it can sometimes be challenging to determine marginal costs, if you’re ready to begin looking at this metric it probably means your business or startup is at a crossroads of producing more and earning more.

But a growing business also comes with growing pains that can prompt questions like, “Where does the balance lie between increasing profit and overproduction?” This is where profit margin analysis comes in.

Keep reading or use the links below to learn about marginal costs, and what looking at marginal costs can tell you about your business.