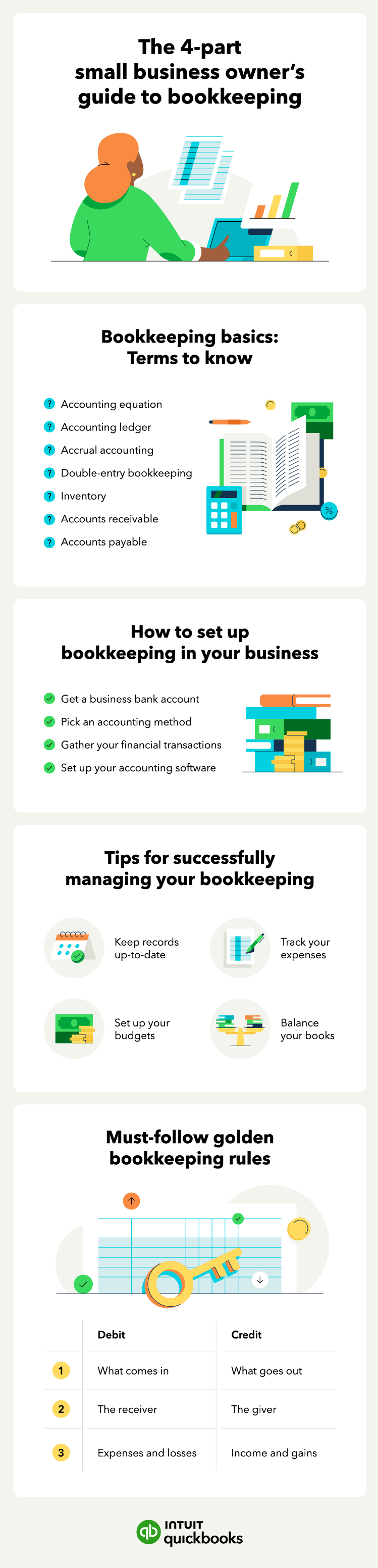

Bookkeeping is one of the fundamental pillars of running a business. A lot goes into it—from managing payables and receivables to balancing books. But what might seem like an overwhelming task isn’t so bad when you break it down into a few simple steps. Any good bookkeeper needs to understand the key terms, so let’s get started.

Bookkeeping basics every small business owner needs to know and use in 2023

What is bookkeeping?

Bookkeeping is the system of recording, organizing, and tracking financial transactions and information for a business or organization.

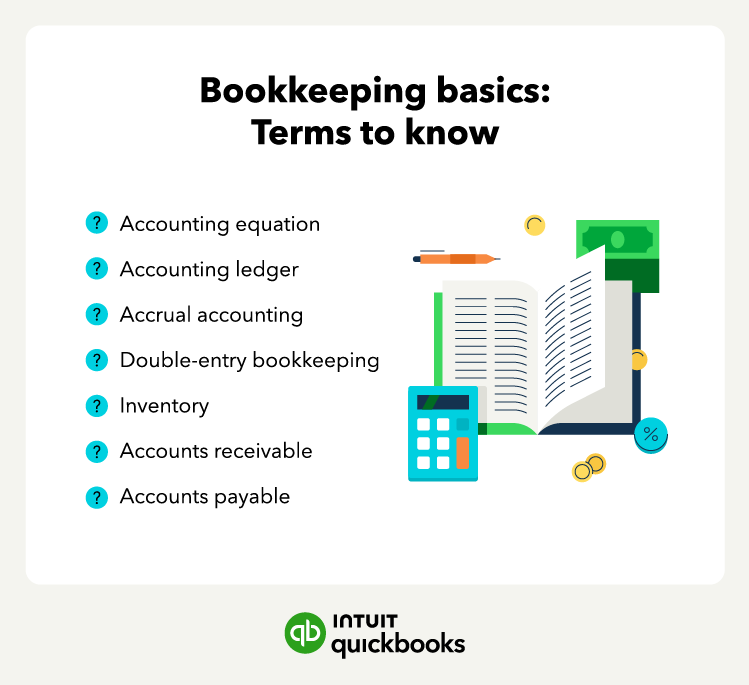

Must-know terms for bookkeeping

Bookkeeping is a critical part of managing your business's financial health. A bookkeeper records and organizes financial transactions to ensure accurate reporting of your business's income and expenses.

While bookkeeping may seem daunting, understanding a few basic concepts can help you get started. Here are seven bookkeeping terms you need to know:

Accounting equation

The accounting equation is the relationship between a business's assets, liabilities, and equity. This accounting formula ensures that the balance sheet remains balanced and accurate. The accounting equation is:

Equity = Total assets - total liabilities

Generally, if your assets are greater than your liabilities, your business is financially stable. Note that certain companies, such as those in service-based industries, may not have a lot of equity or may have negative equity.

Accounting ledger

An accounting ledger is a book or system you use for recording and classifying financial transactions. It’s the foundation of any business's financial recordkeeping.

Your accounting ledger serves as the hub for all your financial information. In particular, all your accounts and transactions. If you have accounting software, it will manage your ledger for you.

Accrual accounting

One of the most popular accounting methods is accrual accounting. The accrual accounting method records financial transactions when they occur rather than when cash exchanges hands.

Accrual accounting provides a more accurate picture of a business's financial health, as it considers all of the financial transactions for a given period. This accounting method is useful for businesses with inventory or accounts payable and receivable.

Double-entry bookkeeping

Double-entry bookkeeping is a system where each transaction is recorded in two accounts—a debit account and a credit account. This system provides a more accurate picture of a business's financial health and helps identify errors in recordkeeping.

For example, when a company purchases inventory on credit, they debit their inventory account and credit their accounts payable account. This shows that the company's inventory increases, but its cash account decreases.

Inventory

Your company’s assets are what it owns and are usually broken down into two categories—current assets and fixed assets. Current assets include cash, accounts receivable, inventory, and prepaid expenses.

Inventory is the stock of goods a business has on hand or in transit, waiting to be sold. The value of inventory can significantly impact a company's financial statements, so accurate tracking and management is vital.

Accounts receivable

Accounts receivable (A/R) is the money your customers owe you for products or services they bought but have not yet paid for. It’s important to track your A/R to ensure you receive payment from your customers on time.

Tracking your A/R, usually with an aging report, can help you avoid issues with collecting payments. As well as set efficient credit terms for your customers.

Accounts payable

Accounts payable is what you owe to creditors for goods or services received but not yet paid for. Managing your AP helps ensure you pay your bills on time and avoid late fees or damage to your credit score.

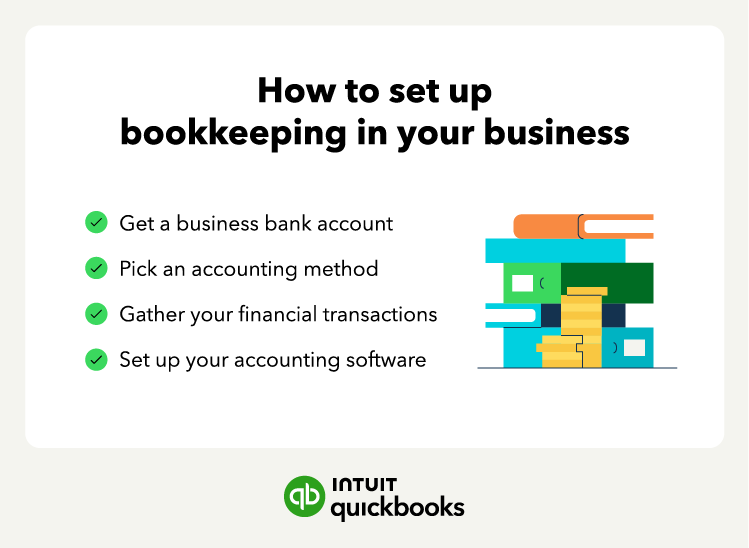

What you need to set up bookkeeping for your business

Setting up bookkeeping for your business is an essential step towards financial success. It lets you track your finances, monitor your cash flow, and make informed financial decisions. But what do you need to get started? Let's take a look at the basics.

Business bank account

The first step you’ll need is a business bank account, which allows you to keep your personal and business expenses separate. Bank accounts are a crucial part of any bookkeeping system—allowing businesses to safely store their money and make transactions easily. There are several types of bank accounts, each with its own purpose and benefits.

The most common type of bank account is a checking account. This type of account is designed for everyday use and allows businesses to make unlimited deposits and withdrawals. Typically, checking accounts also come with a debit card for easy access to funds.

An accounting method

Now it’s time to pick a bookkeeping method. The two key accounting systems are cash accounting and accrual accounting:

- If you carry inventory or have accounts payable and accounts receivable, you’ll likely use accrual accounting.

- If your business is still small, you may opt for cash basis accounting.

A cash accounting system tracks cash flow as it enters and leaves your business in real-time. Under this method, you don't record accounts receivable and accounts payable because they represent future transactions.

Your financial transactions

Financial transactions are business activities that involve money, such as sales, expenses, and payments. Recording and organizing these transactions accurately and timely is essential for effective bookkeeping.

One of the most important aspects of financial transactions is recording them accurately. This involves keeping track of all the money that comes in and out of a business.

Accounting and bookkeeping software can simplify managing your financial transactions—most banks allow you to download account information directly into the program. After you load the data, your only task is to review the entries.

Accounting software

After you have a bookkeeping system in mind, the next step is to pick an accounting software. There’s a variety of spreadsheet software you can use, such as Microsoft Excel, that can be used for simple bookkeeping.

Alternatively, more comprehensive accounting software like QuickBooks can handle a larger volume of transactions and provide a deeper analysis. Either way, having software that easily tracks your transactions is best. But having one that can generate insights, such as an analysis of your cash flow statement, is a big help.

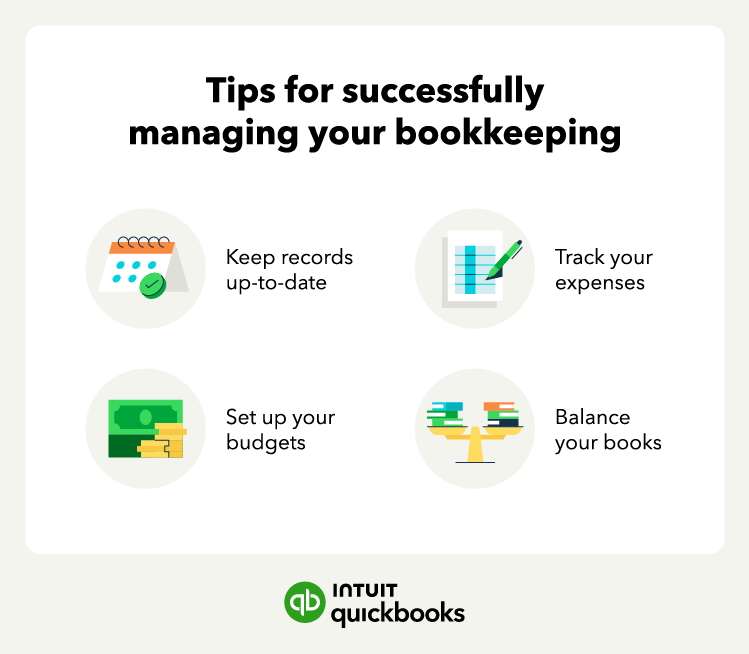

Bookkeeping best practices to be successful

As a business owner, bookkeeping may not rank high on your list of priorities. However, maintaining accurate financial records is key to your business's success.

1. Keep up-to-date records

Accurate financial records are the foundation of good bookkeeping. Without them, it's nearly impossible to make informed decisions about your business's financial health.

Keeping track of financial transactions ensures you have a complete and accurate record of all money coming in and going out of your business. This includes keeping track of:

By maintaining up-to-date records, you'll be able to make informed financial decisions and stay on top of your business's financial health.

2. Track expenses

Tracking your expenses is an essential part of managing your finances, whether you are running a business or managing your personal finances. By keeping track of every dollar you spend, you can gain insight into where your money is going and make informed decisions about allocating your resources.

Here are some tips when tracking expenses:

- Categorize your expenses: Start by dividing your expenses into categories, such as rent, utilities, and supplies.

- Use receipts: Save all your receipts and organize them by category.

- Record everything: Make it a habit to record every expense as soon as possible.

- Regularly review your expenses: Take some time every week or month to review your expenses and compare them to your budget.

- Automate where possible: Many banks and credit card companies offer automatic expense tracking, which can be a helpful tool to ensure that every expense is recorded accurately.

Tracking your expenses may seem tedious, but it’s an essential part of financial management.

3. Set up budgets

Setting up budgets is a key step in managing your business finances. A budget is a plan that outlines your expected income and expenses over a specific period, usually a year or a quarter.

To set up a budget, you'll need to gather your financial data, such as income statements, balance sheets, and cash flow statements. This will give you a clear picture of your business's past financial performance and help you make realistic projections for the future.

Then categorize your expenses into different categories, start estimating your expected revenue for the upcoming period, and allocate your expenses accordingly.

4. Balance your books

Balancing your books allows you to catch any errors or mistakes in your bookkeeping. A good practice is to balance your books once a month.

To uncover errors, check whether you forgot to record an entry in either column of your accounting ledger. Or if you listed the same entry twice. If not, try looking for a couple of common accounting errors.

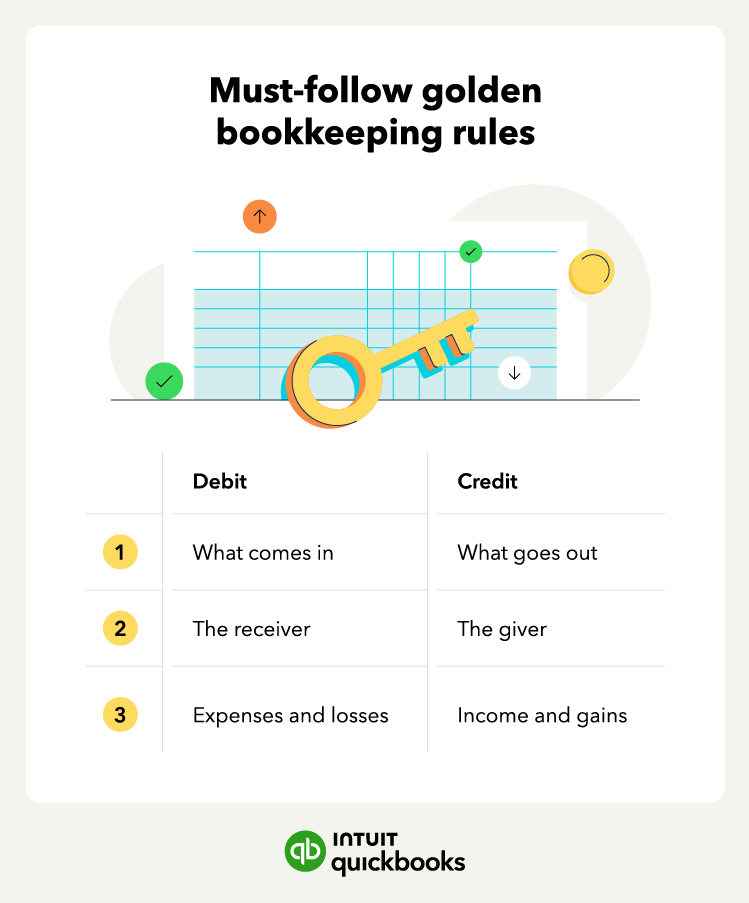

The 3 golden rules of bookkeeping to follow

One of the best things you can do to ensure your books balance properly is to follow the three golden bookkeeping rules.

The three golden rules bookkeepers should pay special attention to are:

- Debit what comes in, credit what goes out

- Debit the receiver, credit the giver

- Debit expenses and losses, credit income and gains

The debited account is the one that receives or loses value, and the credited account is the one that gives or gains value. The golden rules of accounting will ensure you avoid making bookkeeping errors.

The golden rules also help ensure that your bookkeeping is accurate and up-to-date. Note that the golden rules assume you use the double-entry bookkeeping system.

Streamline your accounting and save time

Poor bookkeeping practices can lead to financial troubles. By learning bookkeeping basics—with the help of bookkeeping courses—you can keep your business on track and set yourself up for success.

Whether you balance your books using accounting software, bookkeeping services, or a combination of both, understanding how the process works is a critical skill.