1. Think about what you really need to make a sale

It’s easy to assume that a brick-and-mortar location is essential to moving products off the shelf and into customer hands. But Spaulding says retail isn’t the answer for everyone.

“You may not necessarily need that. People drastically undercount [sic] how expensive, difficult and time consuming it is to deal directly with consumers.” Turning to retail before your business is ready for that step can impact your business choices — and not always for the better.

It’s a lesson Spaulding says she learned first-hand. “Because we were so ill-prepared for a specific retail scenario, we were consumed with our consumer,” she says. Goals like scaling production were put on hold, as that time and energy was rerouted to answering in-person customer requests. It wasn’t long before three SKUs turned into 45, but just how profitable were those additional 42 products? To find out, Spaulding knew she needed to dive deep into her sales analytics.

2. Don’t wait to identify your hero product

“Small business owners wait too long to think about scaling,” says Spaulding. “You need to have a timeline on identifying your ‘hero product’.”

For Spaulding, a hero product doesn’t necessarily mean outstanding sales — it has more to do with profit margins.

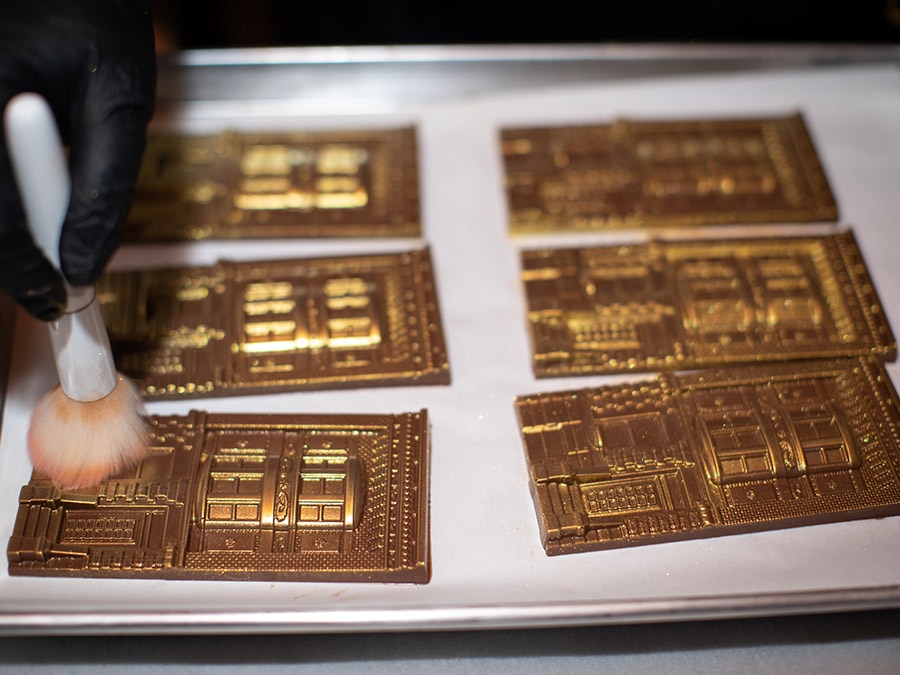

“We had this one SKU that sold out all the time. I mean, literally in minutes. When we had 'em online, they [sold] out all the time.” The product was Harlem Chocolate Factory’s chocolate turtles.