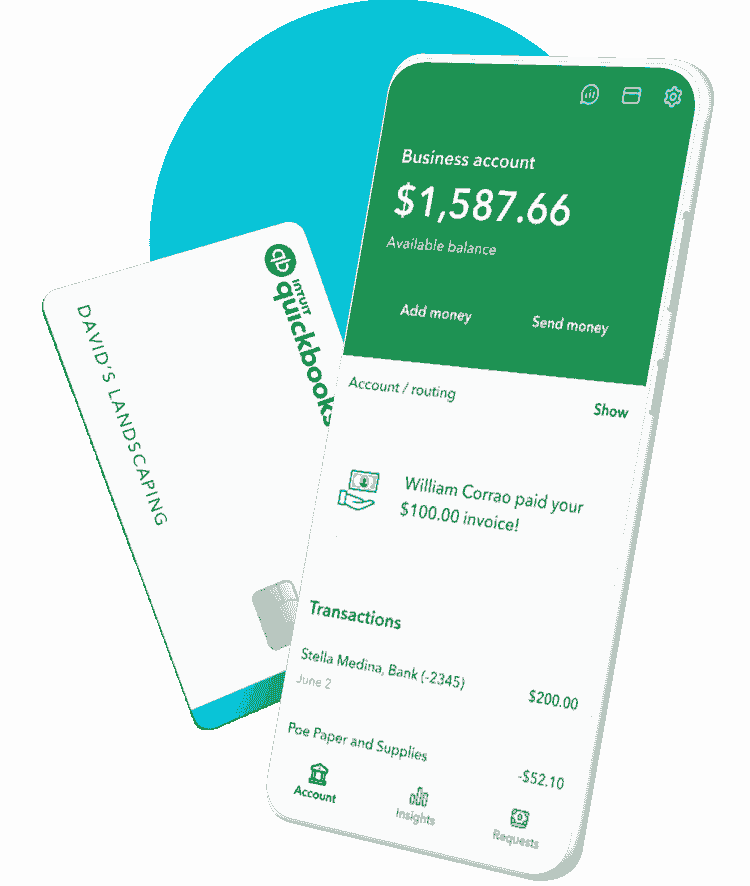

QUICKBOOKS MONEY

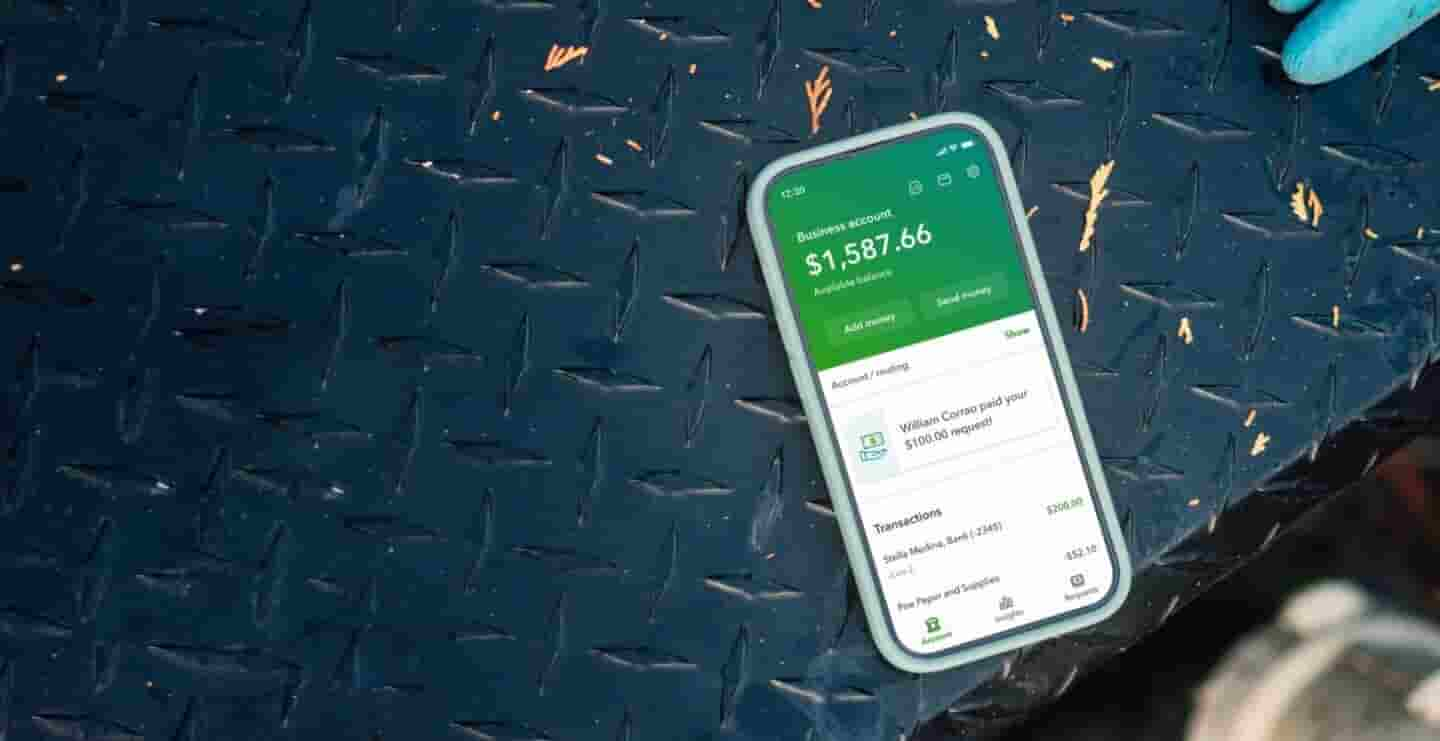

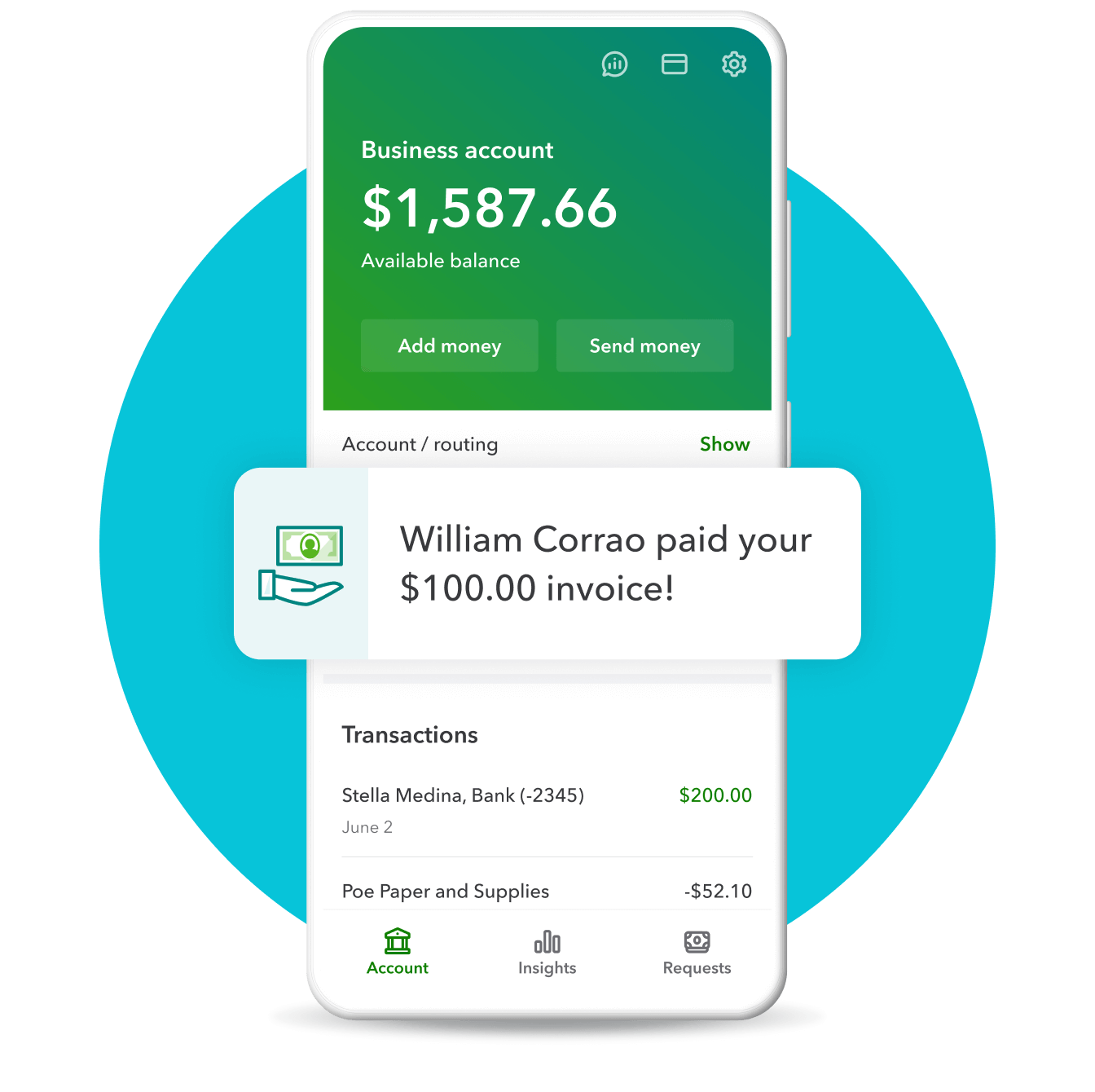

Manage your business money all in one place

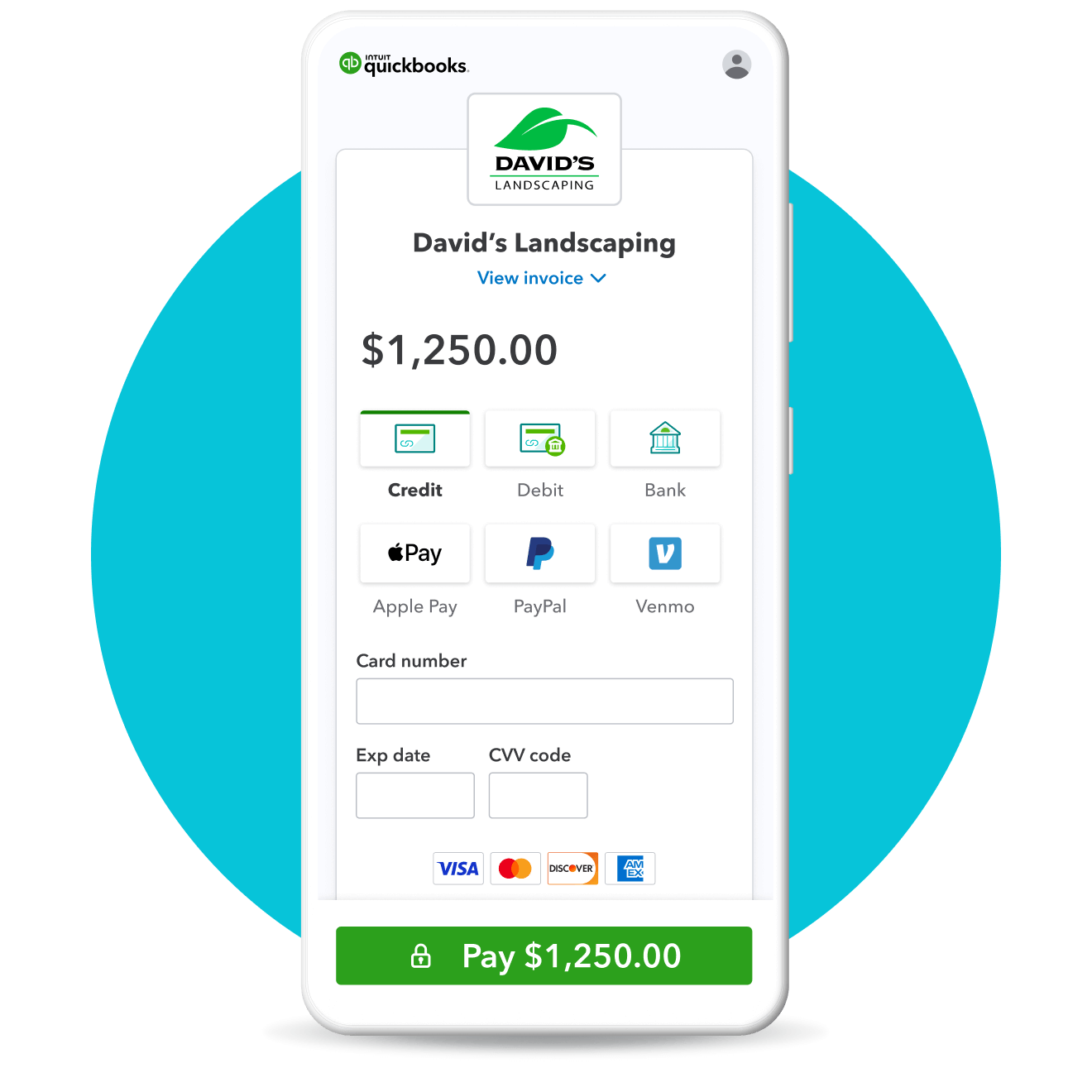

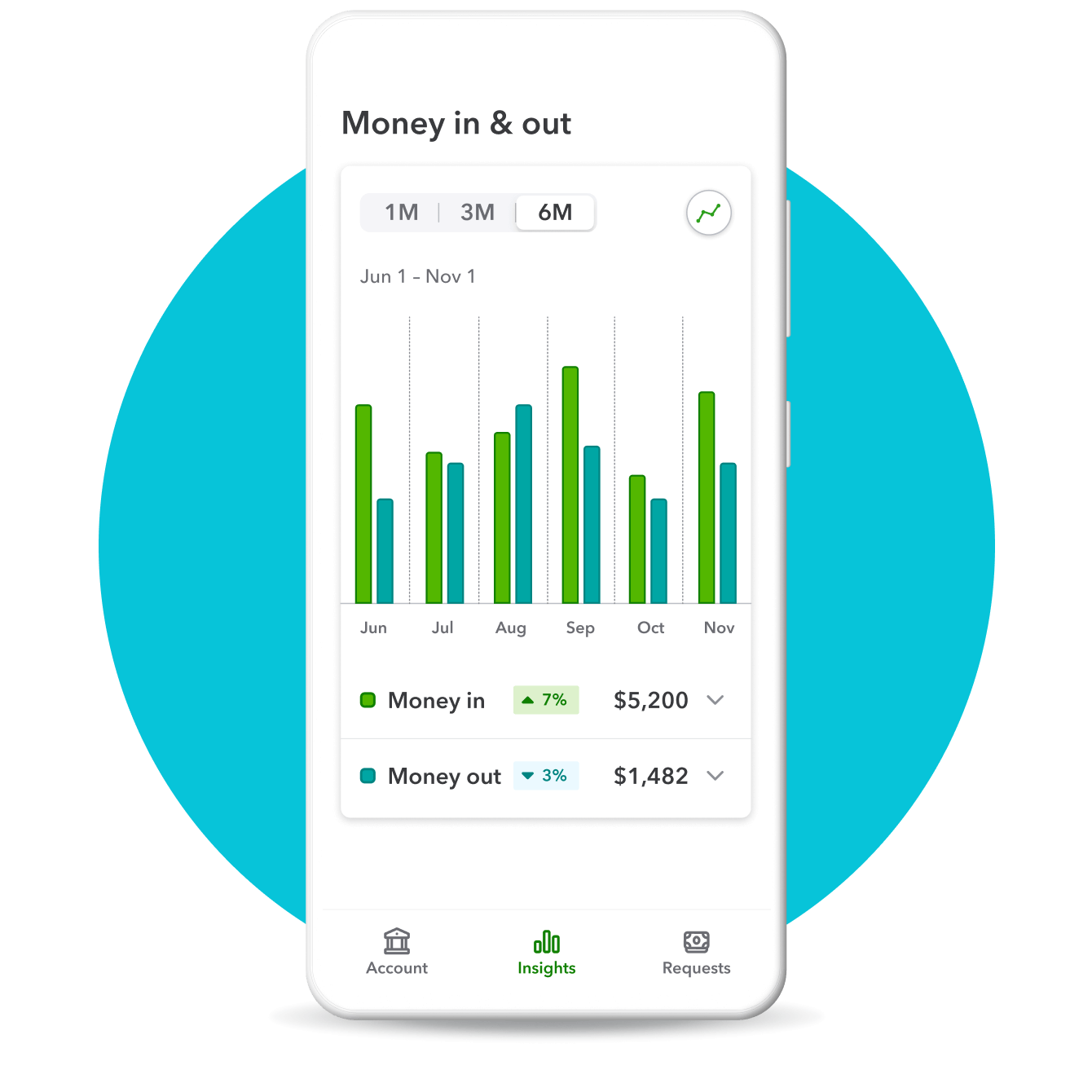

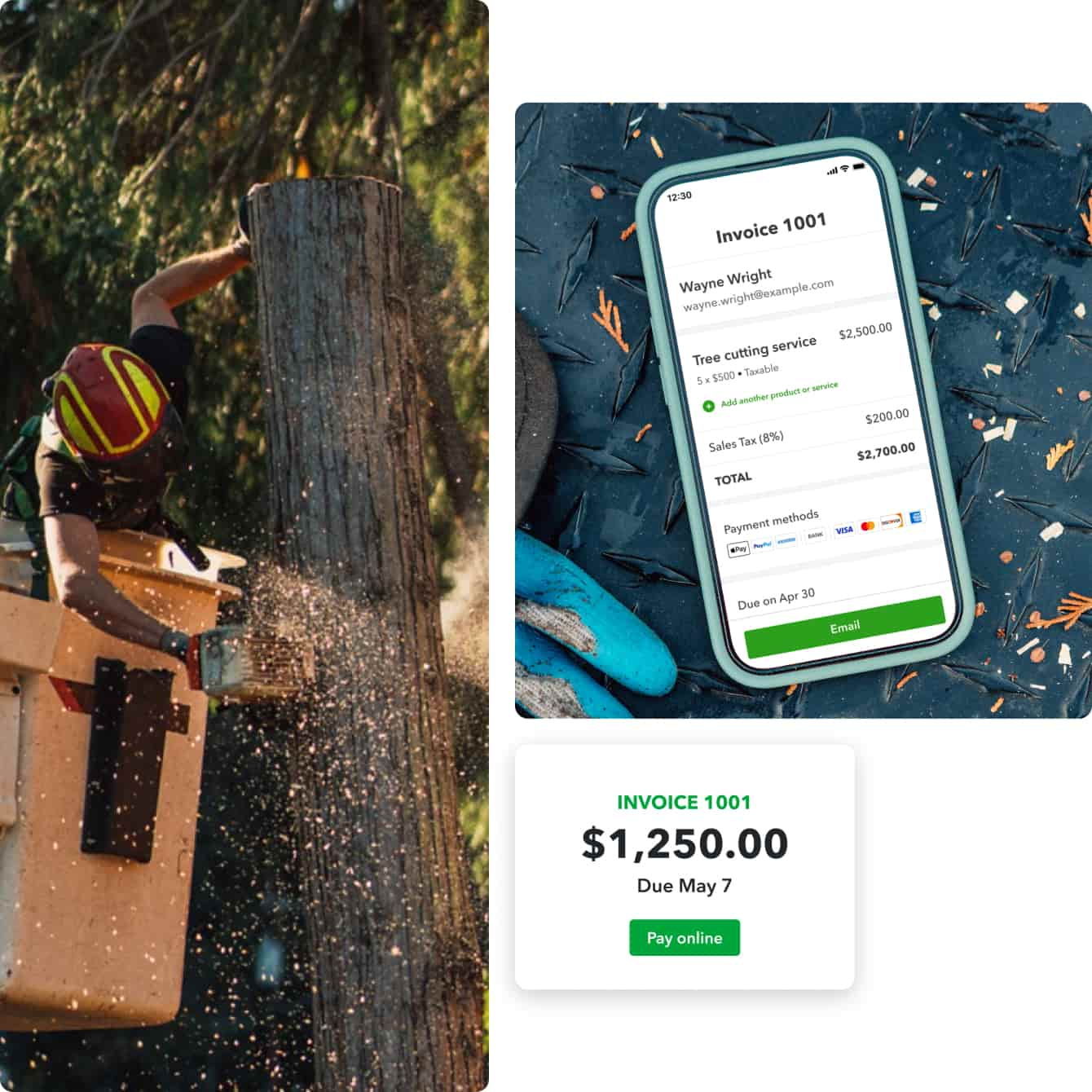

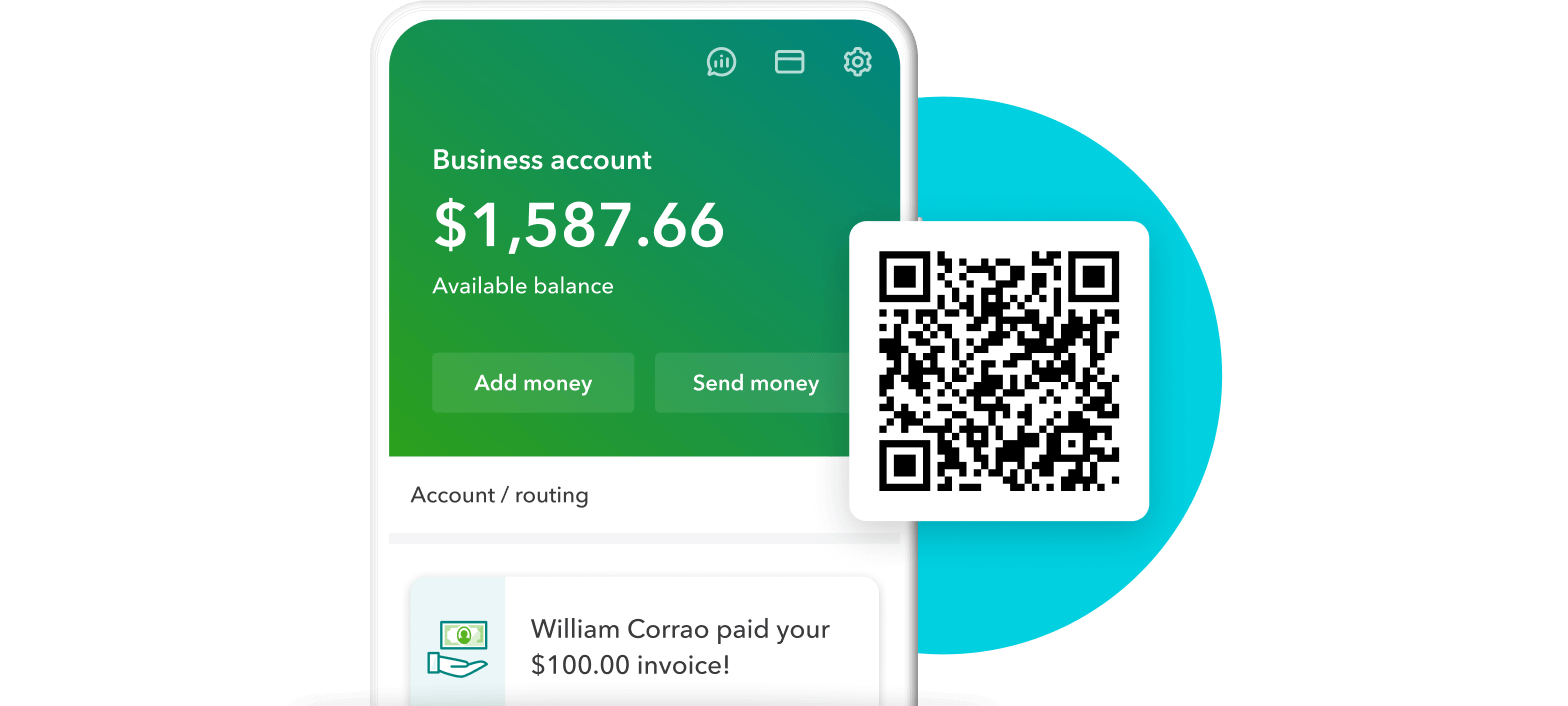

QuickBooks Money can help you build your business. Get a mobile bank account and debit card, send invoices, accept payments, and get cash flow insights. No monthly fees.**

QuickBooks and Intuit are a technology company, not a bank. Banking services provided by our partner, Green Dot Bank.