Paying a 1099 contractor is done either manually through cash or check, or digitally through direct deposit or a third party like Venmo. The key to a healthy relationship with your contractors—and remaining in good standing with the IRS—is to follow the proper payment process. Here are a few key steps to follow to make sure you pay your 1099 workers correctly:

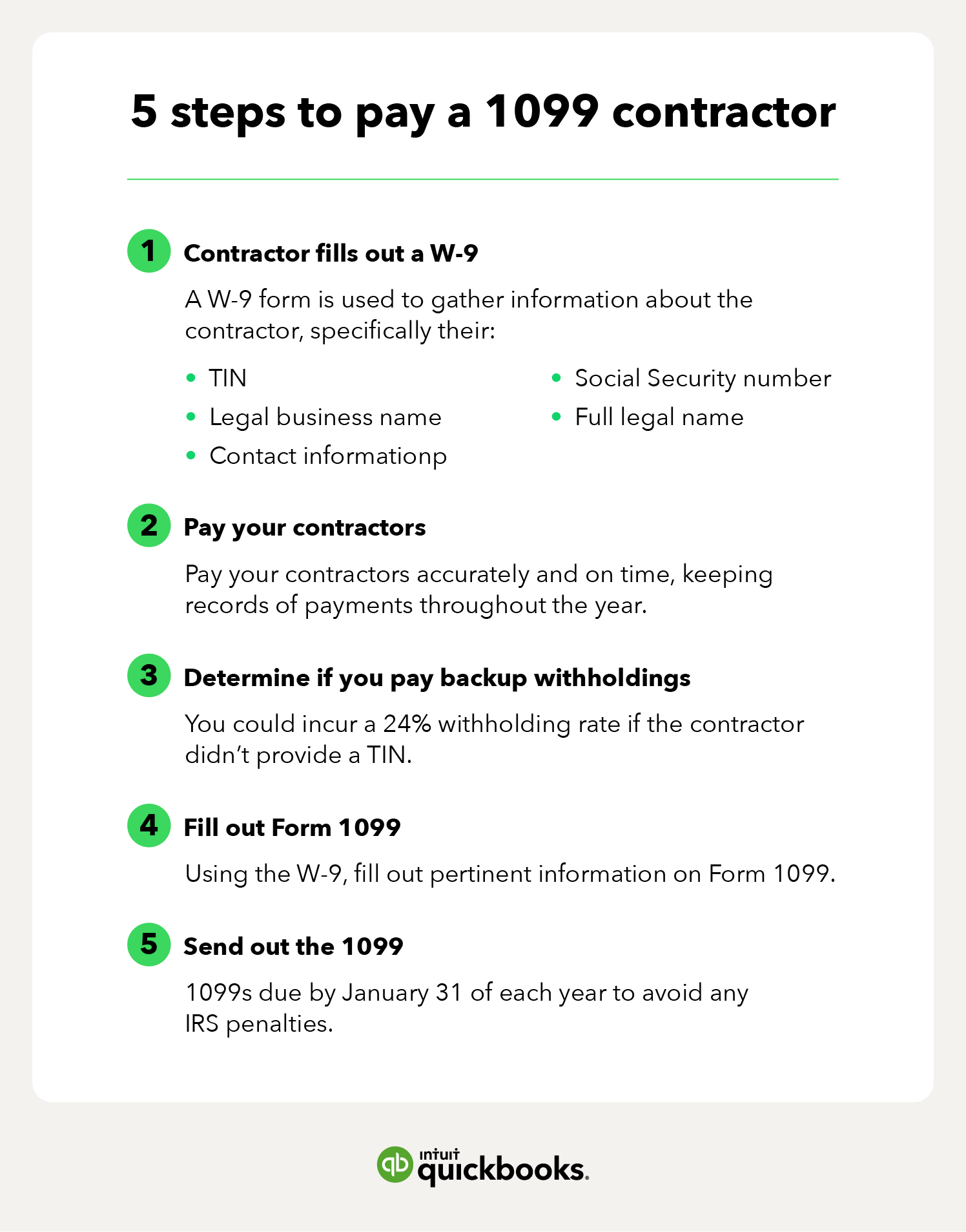

Step 1. Have each contractor fill out a W-9

While this might seem like a small step, it is essential to properly complete their 1099. It’s best to get a W-9 from the contractor as soon as you start working with them.

What is a W-9?

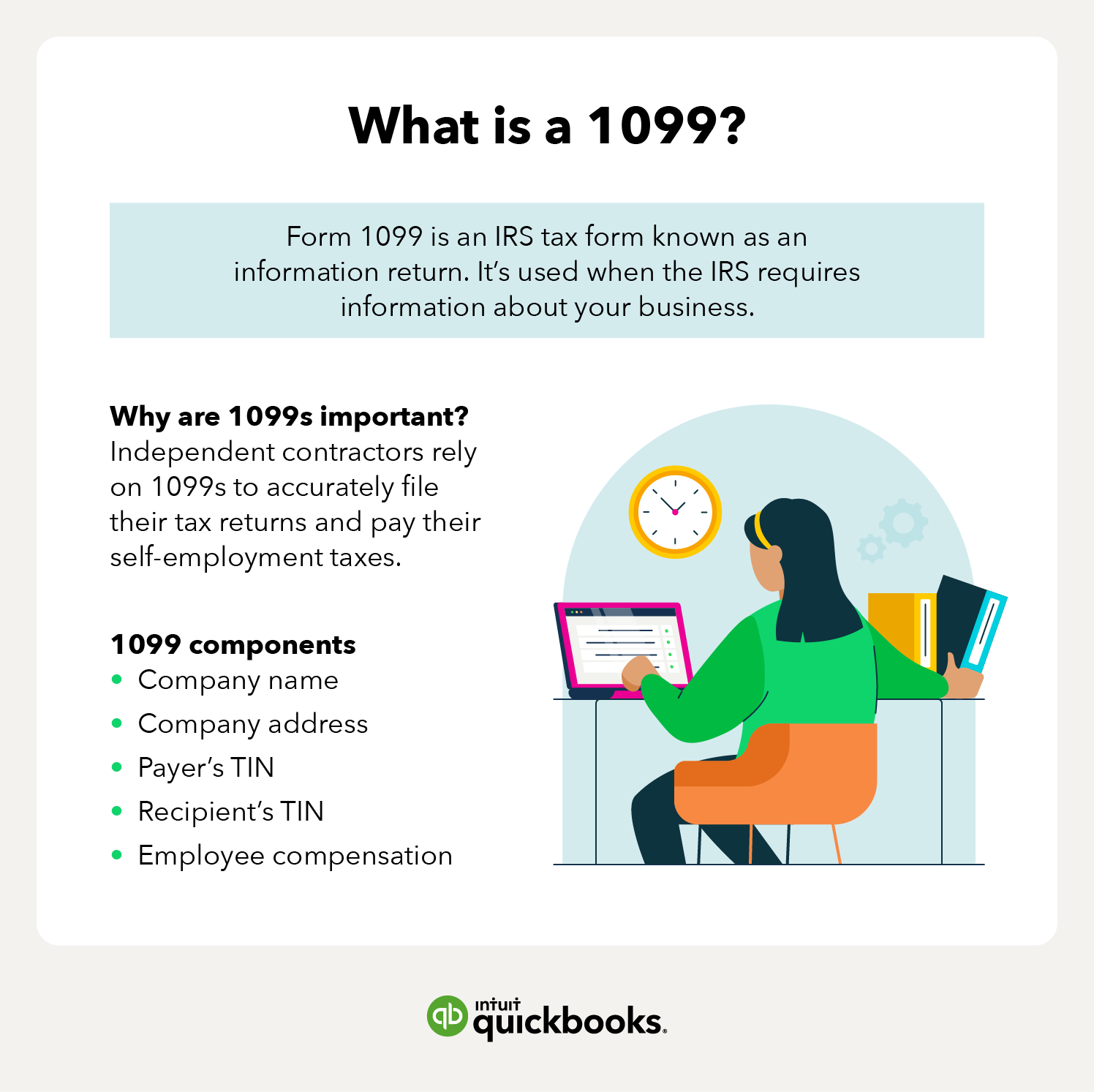

Form W-9 is a payroll form used to gather information about the contractor, specifically their:

- TIN

- Legal business name

- Contact information

- Social Security number

- Full legal name

There is no official deadline for the W-9, but you should ensure that you receive it from each contractor before the end of the tax year.

Step 2. Pay your contractors accurately and on time

Since 1099 workers aren’t on payroll, you will need to manually pay them via cash or check or an online solution such as PayPal or Venmo. To further simplify things, you can also use payroll services and software like QuickBooks to automatically track invoices and make payments for each independent contractor.

Step 3. Determine whether you are responsible for backup withholdings

Typically, you won’t have to worry about withholding for 1099 workers because they are responsible for paying self-employment taxes on their income tax returns. Self-employment taxes cover Medicare and Social Security taxes that are traditionally paid by employers on behalf of their employees.

TIN matching

If the contractor did not provide a TIN—or provided the wrong TIN—you may be responsible for backup withholdings on their behalf. If this is the case, the withholding rate is 24%.

To avoid this, you can use two IRS services that match up to 25 companies and verify their W-9 information:

- Interactive TIN matching

- Bulk TIN matching

Step 4. Fill out Form 1099 and send it to the contractor

This is where the information from the W-9 comes in handy. You will fill out the 1099 with the contractor’s information, including:

- Their legal name

- Their TIN

- Their business entity type

- The total amount you’ve paid them throughout the year

If you use payroll software, you’ll have payment information readily available. If you don’t, then you’ll need to compile the information by hand. Once you complete Form 1099-MISC/NEC, you should send Copy B to the contractor so they can file their taxes. Hold on to Copy A for your taxes.

When do I send out 1099s?

If you are issuing 1099s to vendors, you need to send them out by January 31 at the latest. According to the IRS, requiring businesses to comply with this deadline helps “fight tax fraud and verify income reported on individual tax returns.”

Stress-free 1099 prep

Tax season is stressful enough without the added pressure of missed deadlines and penalties. Be aware that 1099s sent after the deadline are considered late. If you fail to send a Form 1099 by January 31, you may be subject to IRS penalties.

For example, small businesses—those with gross receipts of $5 million or less—may have to pay $50 per late form. This penalty can add up quickly, so make sure you set a reminder for the 1099 deadline.

For assistance in preparing, sending, and submitting 1099 documents, you may want to consult your CPA or a tax professional.