Features that fit your business

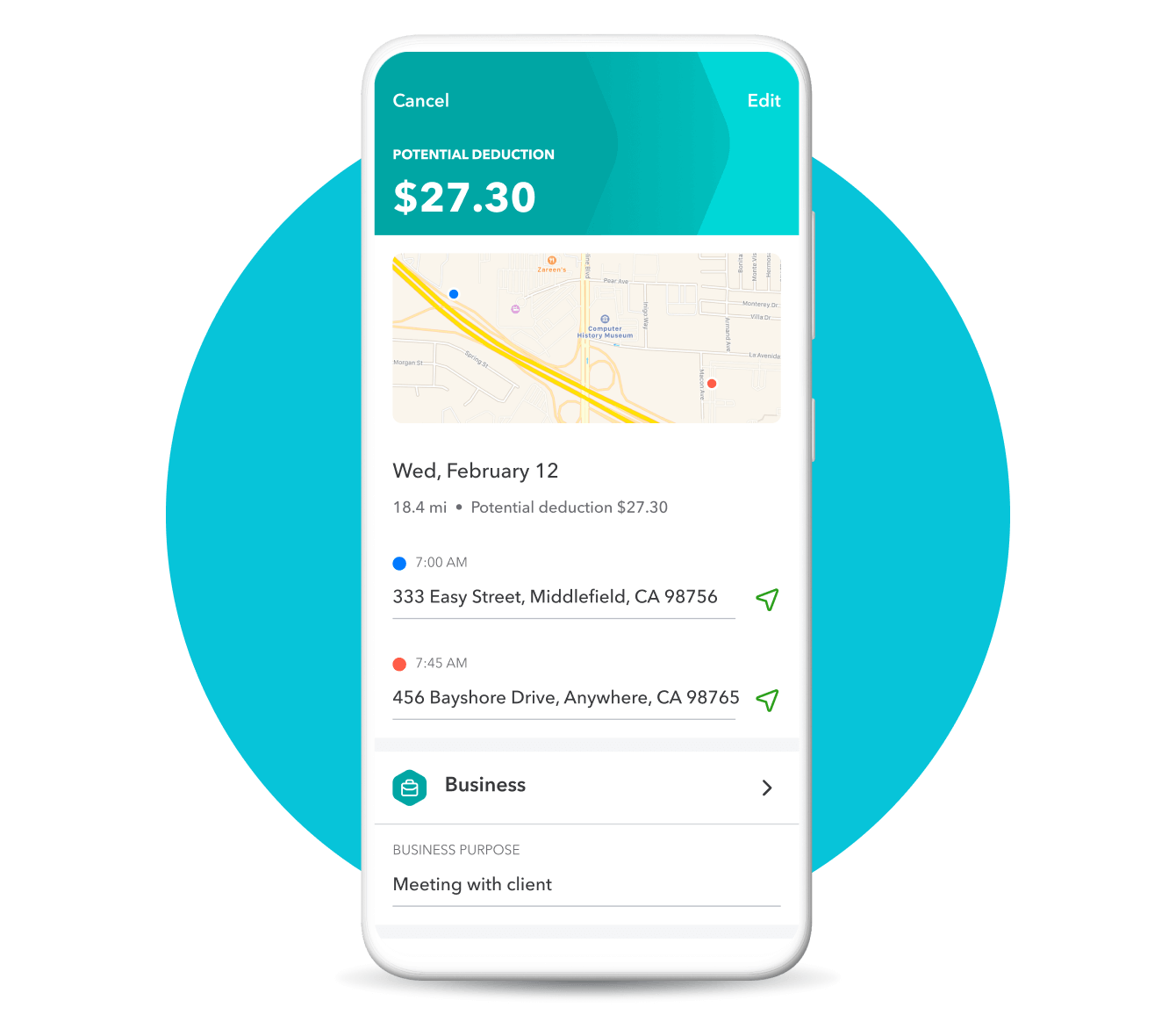

Track mileage

Track mileage automatically via your phone’s GPS and categorize trips with a swipe.

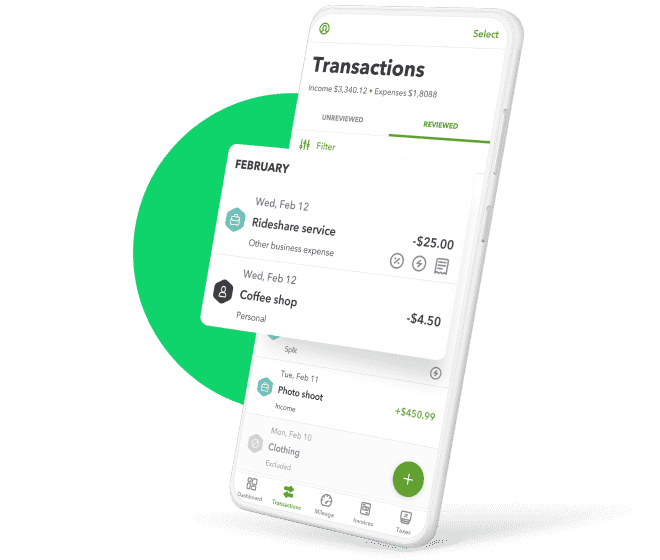

Sort expenses

Import expenses directly from your bank account and effortlessly sort business from personal.

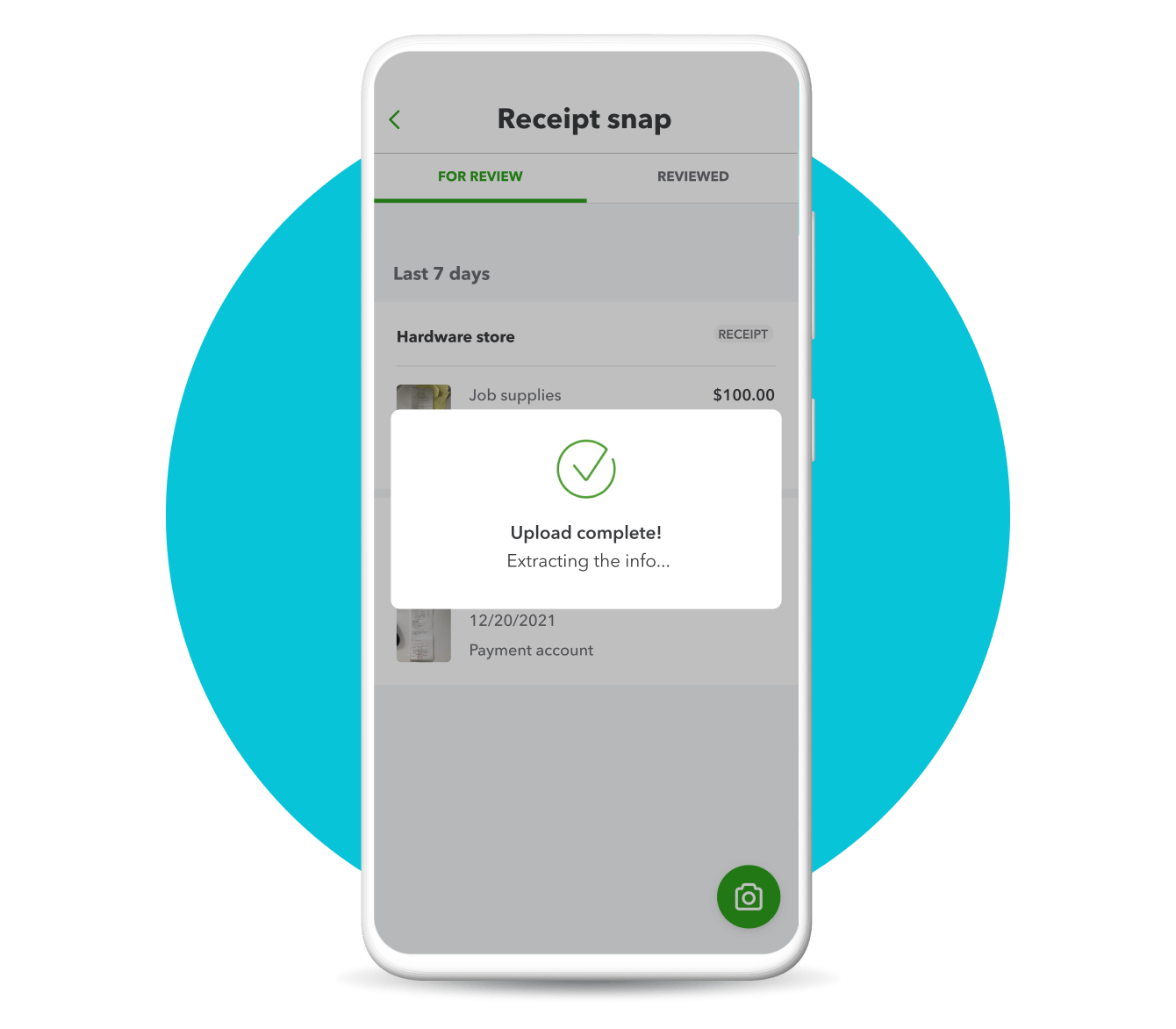

Organize receipts

Snap a photo of your receipt and we’ll match and categorize expenses for you.

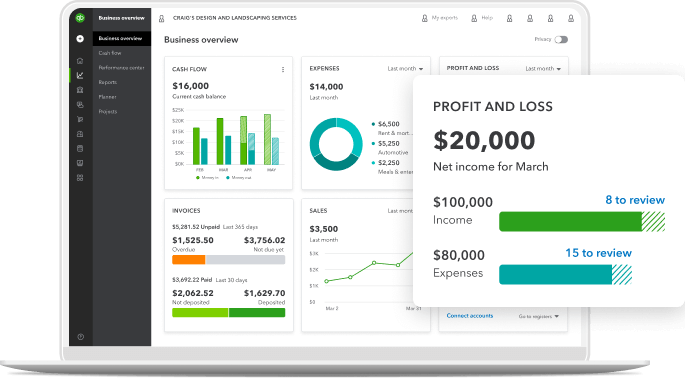

Run reports

Use built-in reports to see how your business is doing and take advantage of opportunities.

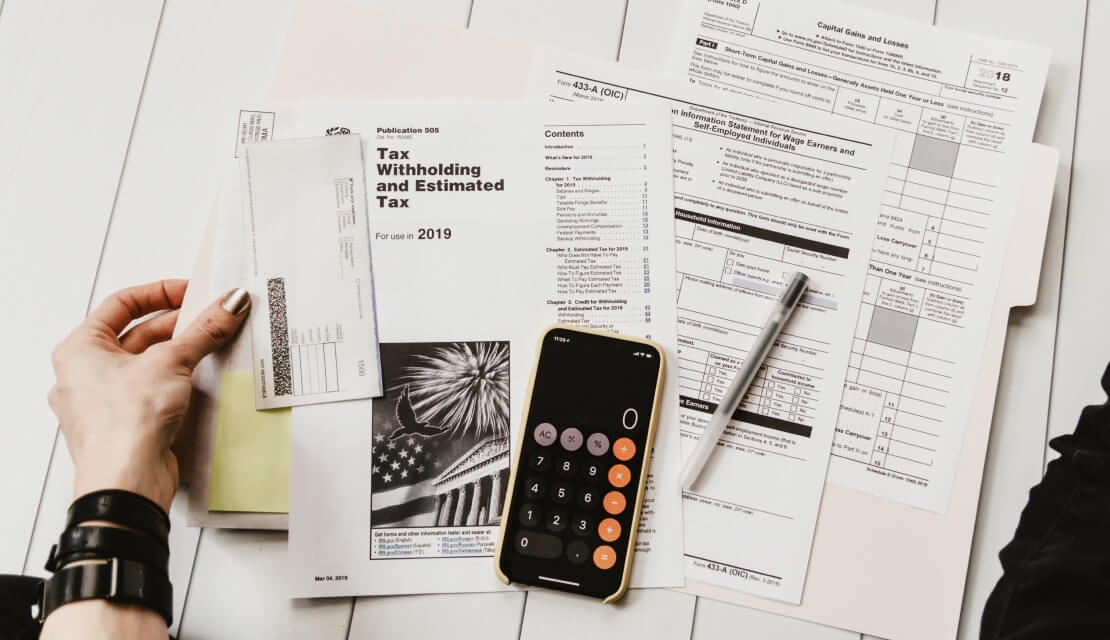

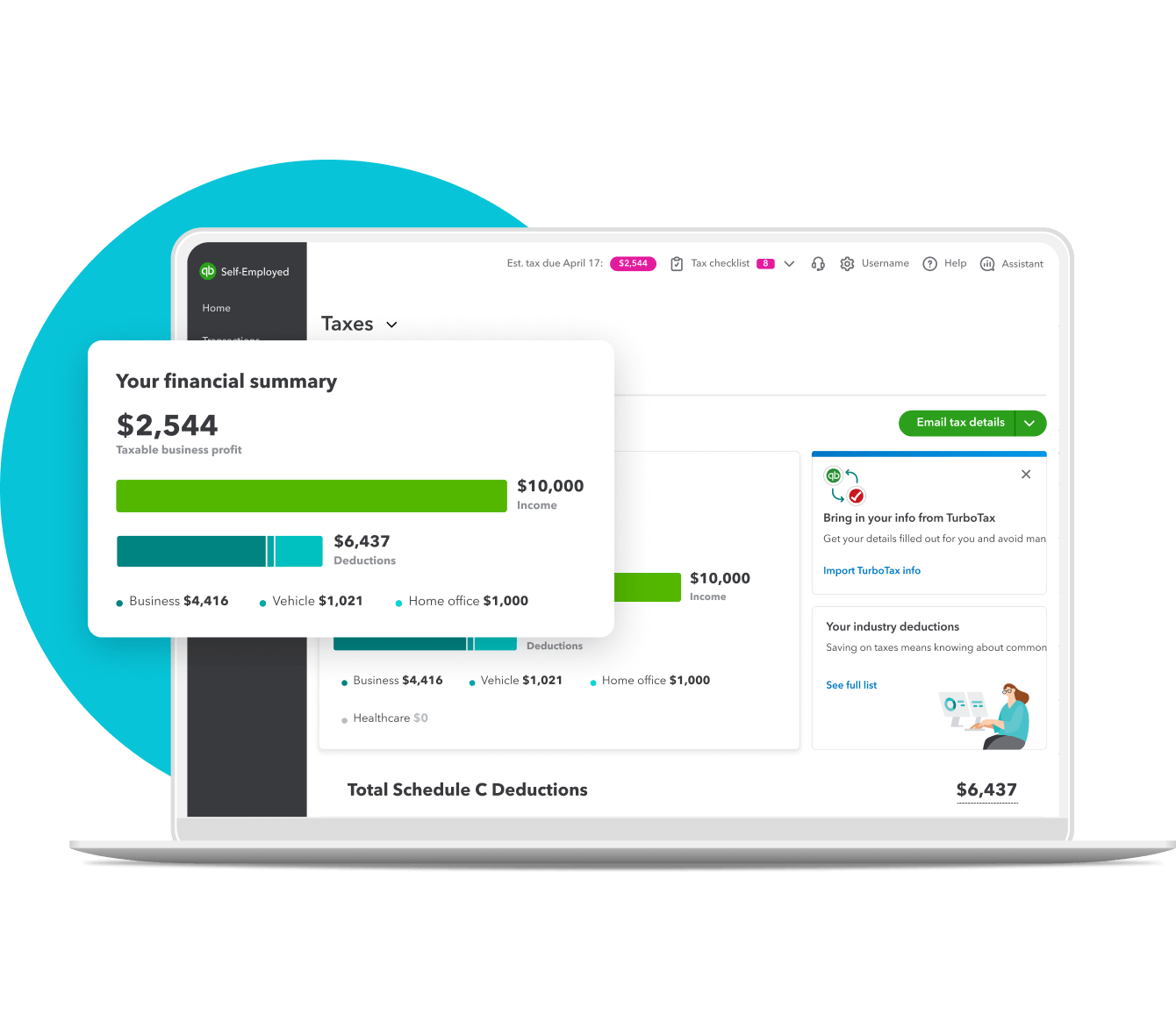

Estimate taxes

We do the math and automatically remind you of what you owe each quarter and when it’s all due.

File taxes

With the TurboTax bundle, you can instantly transfer your financial data.

Flexible plans for independent contractors and freelancers

Put more money in your pocket

Receipts and expenses are stored, organized, and ready for when you need them.

We’ll find deductible business expenses that you didn’t know about and auto-categorized for your Schedule C.

Sort expenses with a swipe, track your mileage, and prep for taxes, all from your smartphone.